In a world where investment trends are constantly shifting, understanding where funds are flowing and why can be the key to unlocking future success.

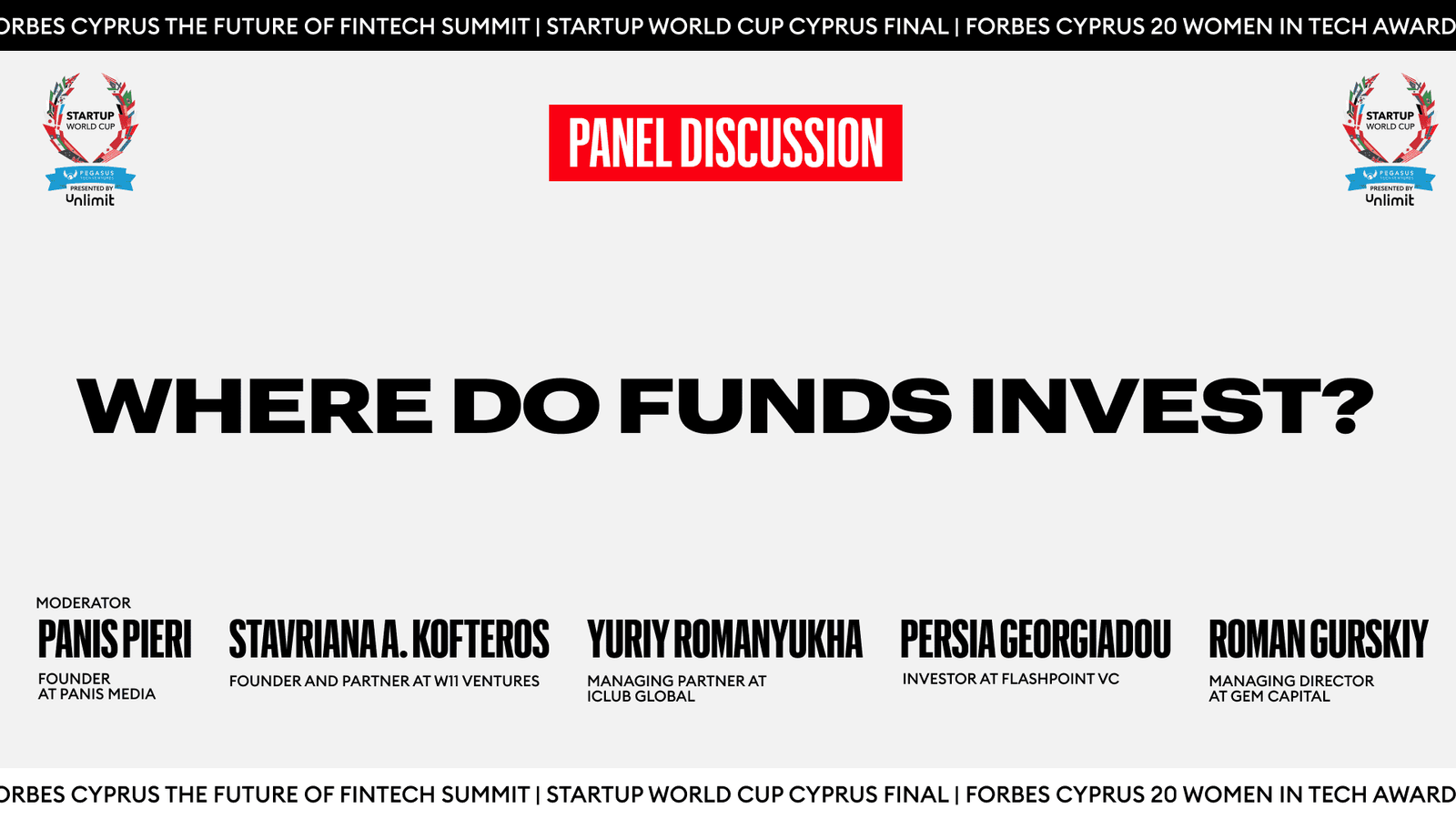

At a recent panel discussion with the title “Where do funds invest?” at the Startup World Cup 2024, moderated by Panis Pieri, the founder of Panis Media, prominent figures from the venture capital (VC) sector convened to discuss the current investment landscape and emerging opportunities. The panel featured industry leaders including Persia Georgiadou, Investor at Flashpoint VC, Yuriy Romanyukha, Managing Partner at ICLUB Global, Roman Gurskiy, Managing Director at GEM Capital, and Stavriana A. Kofteros, Founder and Partner at W11 Ventures.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

A Shifting Paradigm

Persia Georgiadou, representing Flashpoint VC, set the stage by providing a macroeconomic overview of the investment climate across Europe and the United States. Traditionally, the US has dominated the venture capital scene, attracting the majority of international investors. However, Georgiadou pointed out that Europe has been narrowing the gap in recent years, with countries like the United Kingdom and Germany emerging as significant hubs for VC activity.

Despite global economic uncertainties, 2023 has seen a resurgence of investment activity, driven by what Georgiadou described as “dry powder” left over from previous years. This capital surplus has intensified competition, leading to an uptick in valuations across various sectors. She highlighted artificial intelligence (AI) and climate technology as areas of particular interest. These sectors are benefiting not only from technological advancements but also from regulatory shifts and increased environmental awareness, creating a fertile ground for economic opportunities.

Navigating Early-Stage Investments and Exit Strategies

Yuriy Romanyukha brought his expertise to the discussion by focusing on early-stage investments, an area where ICLUB Global has carved out a significant niche. Romanyukha emphasised the importance of having a well-defined exit strategy, noting that the current market environment has seen a rise in secondary sales. These transactions allow early investors to exit without waiting for an initial public offering (IPO) or a large-scale merger and acquisition.

Romanyukha offered a cautious note on the AI sector, recognising its current prominence but warning that its bubble may not last indefinitely. He pointed to emerging fields such as robotics and biotech as the next frontiers for innovation and investment. For investors, Romanyukha’s advice was clear: focus on early-stage companies with strong market positioning and be prepared to capitalise on secondary sales opportunities, especially given the closed IPO market predicted for the next two years.

The Unstoppable Growth of the Gaming Industry

Roman Gurskiy, representing GEM Capital, provided a compelling case for the gaming industry as a prime investment opportunity. Unlike many other sectors, the gaming industry is inherently global, with no significant barriers to entry between markets. This global reach, combined with the industry’s resilience during economic downturns, makes gaming an attractive proposition for investors.

Gurskiy highlighted the fact that gaming is now the largest form of entertainment globally, surpassing both the film and music industries. This growth has been further amplified by the integration of gaming into mainstream pop culture, as evidenced by the success of gaming franchises in television and film. While the gaming sector may have fewer buyers compared to traditional industries, Gurskiy argued that the balance between the number of startups and potential acquirers remains healthy, ensuring viable exit opportunities for investors.

The Critical Role of Corporate Partnerships in Startup Scaling

Stavriana A. Kofteros, a veteran in the startup ecosystem, shifted the discussion towards the importance of corporate partnerships in scaling B2B startups. Drawing on her experience with W11 Ventures, Kofteros underscored the growing realisation among corporations that they cannot innovate in isolation. The pace of technological advancement and the scarcity of tech talent have pushed many corporates to seek out startups with innovative solutions to their challenges.

For startups, these partnerships offer more than just validation; they provide a crucial lifeline for growth. Kofteros emphasised that successful corporate partnerships can significantly enhance a startup’s investment readiness, making them more attractive to venture capitalists who are increasingly looking for validated products with paying customers. In her view, the alignment of corporate needs with startup innovation is not only beneficial but essential for the future growth of both parties.

Geopolitical Influences and Emerging Regional Markets

The panel also explored the impact of geopolitical factors on investment decisions, with Georgiadou reflecting on the cautious stance many venture capitalists adopted during 2022 and 2023. The uncertainties of these years led to a slowdown in new investments, as VCs hesitated to deploy capital amidst an unpredictable global environment. However, as 2024 approaches, there is a shift in mindset. Investors are now focusing more on profitability and the clear path to achieving it, rather than growth at all costs.

Yuriy Romanyukha identified specific regions that are currently overlooked but ripe with potential. He cited the Gulf region, particularly Saudi Arabia and Bahrain, as untapped opportunities for Cyprus-based businesses. Additionally, he highlighted Singapore as a strategic entry point for accessing markets across Central Asia and the broader APAC region. For investors and entrepreneurs looking to expand into LATAM, Romanyukha recommended Brazil as a focal point, given its burgeoning ecosystem of founders and investors.

Future of Funding: Expert Insights and Advice

As the panel drew to a close, each expert offered their perspectives on the future of funding. Stavriana A. Kofteros emphasised the cyclical nature of the economy, advising startups to ensure their business models are validated and that they have a clear, actionable plan for market entry. She also highlighted the importance of non-equity funding options, such as the European Investment Fund’s deep tech fund, which provides a blend of grants and equity to scale European startups.

Yuriy Romanyukha encouraged startups to seek guidance from seasoned founders before approaching venture capitalists. These founders, he argued, can offer invaluable insights and strategic advice that can shape a startup’s vision and enhance its attractiveness to investors.

Persia Georgiadou echoed the need for startups to maintain a sharp focus on their go-to-market strategy. Experimentation is important, she noted, but startups must remain disciplined and avoid spreading themselves too thin.

Finally, Roman Gurskiy expressed confidence in the future of the gaming industry, reiterating its resilience and continued growth prospects.