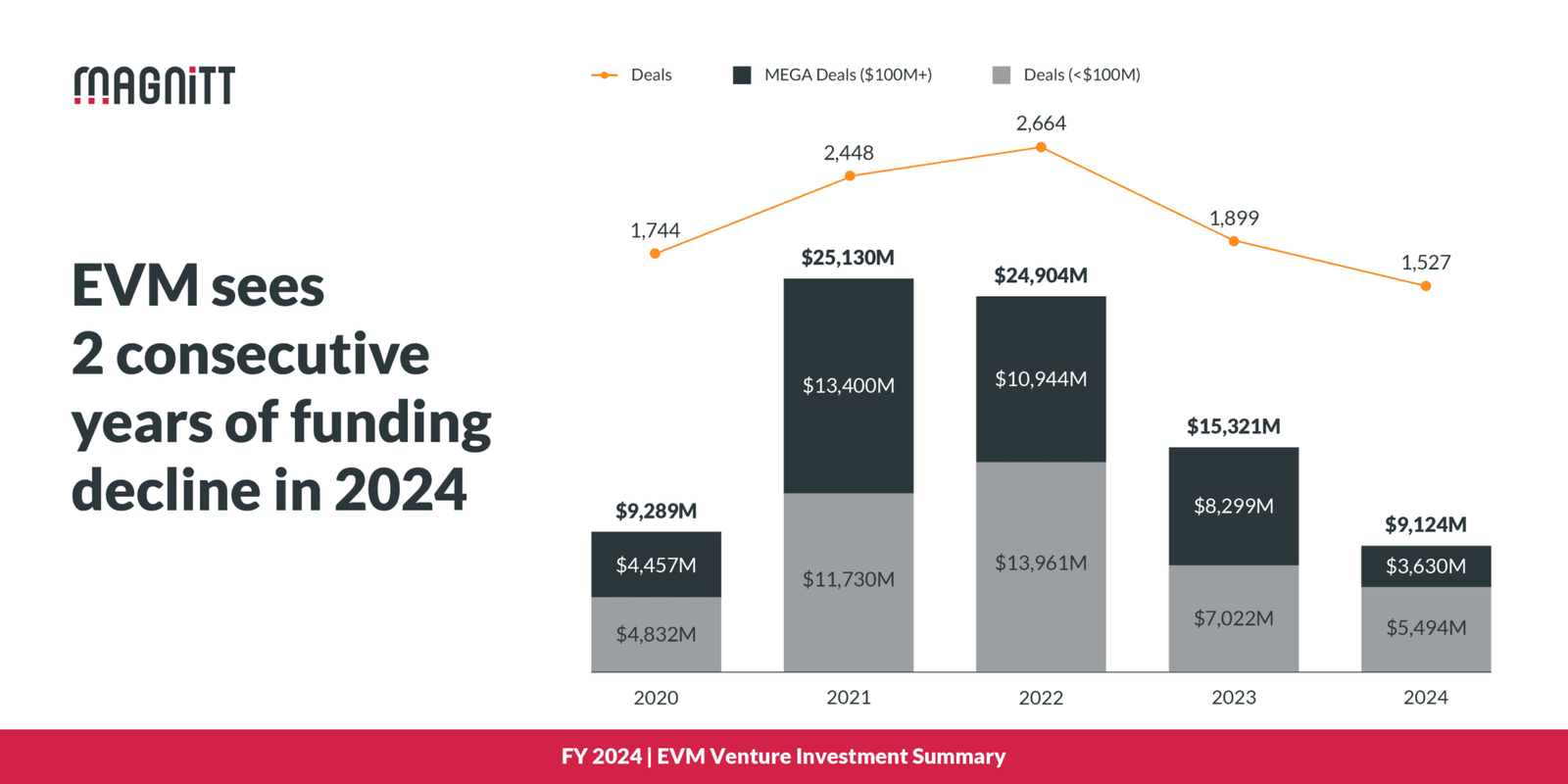

According to a new report, venture capital investments in Emerging Venture Markets (EVMs)—comprising the Middle East, Africa, Pakistan, Türkiye, and Southeast Asia—reflect a stark 40% year-on-year decline. While this headline figure underscores these markets’ challenges amid a global funding slowdown, the story is far from one-dimensional. Beneath the surface, intriguing trends point toward resilience and potential recovery.

A Mixed Bag Of Results

The $9.1 billion raised by startups in EVMs marks a significant drop from 2023, a 40% decline year-on-year (YoY). However, the total number of investors grew by 2% YOY, reaching 1,707. This uptick hints at the possibility of a brighter 2025, as investor confidence remains intact even amidst economic turbulence.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

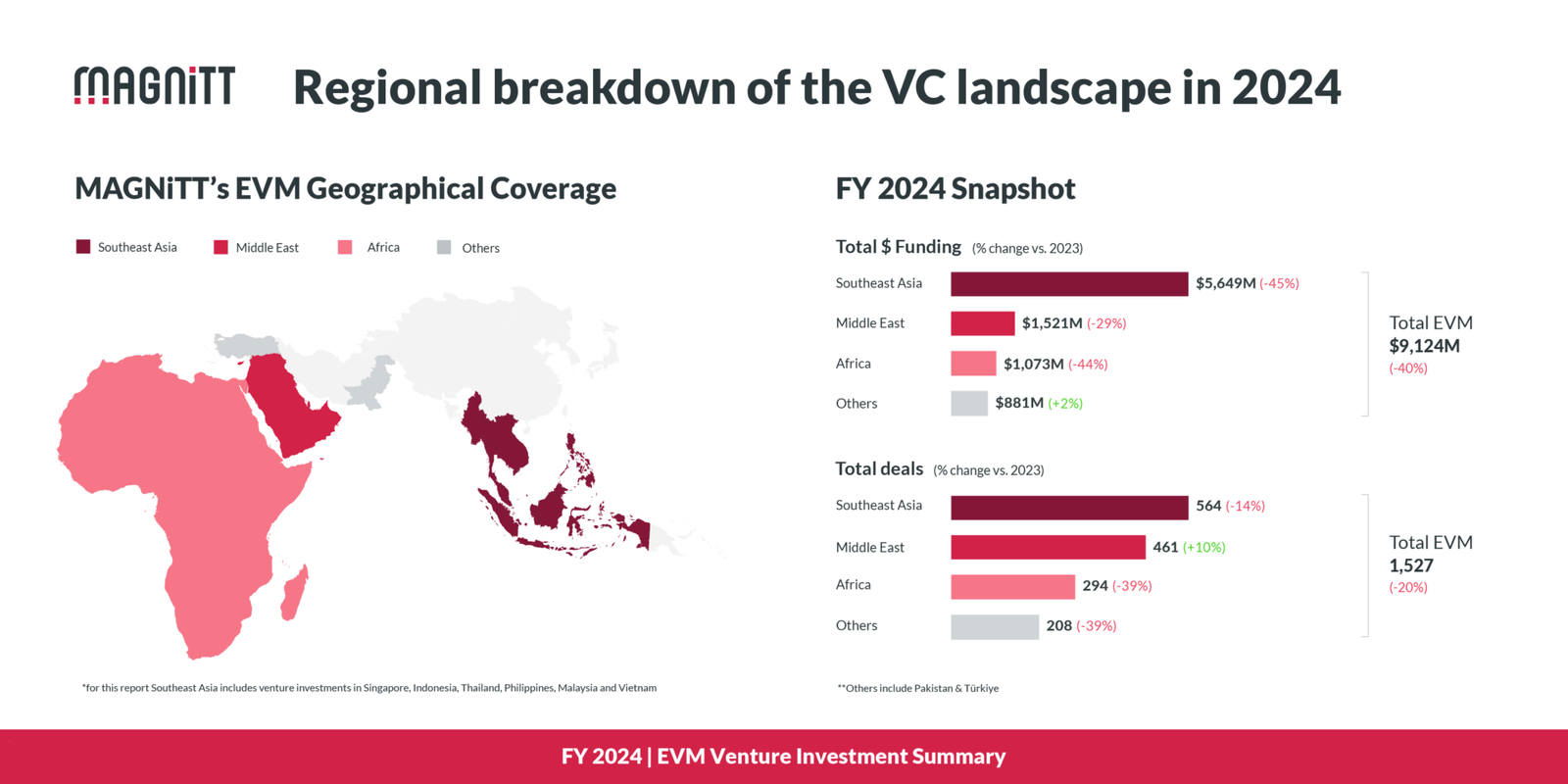

Breaking down the regions, Southeast Asia experienced the sharpest contraction, with funding plummeting by 45%, followed closely by Africa at 44%. The Middle East, however, proved relatively resilient. Not only did it see a smaller funding decline of 29%, but the region also recorded a 14% increase in total investors, signaling sustained interest from both local and international backers.

Global exits in 2024 fell by 32%, with just 94 recorded across EVMs. Late-stage funding, too, became scarcer as public markets remained challenging, emphasizing the difficulty startups faced in scaling beyond early rounds.

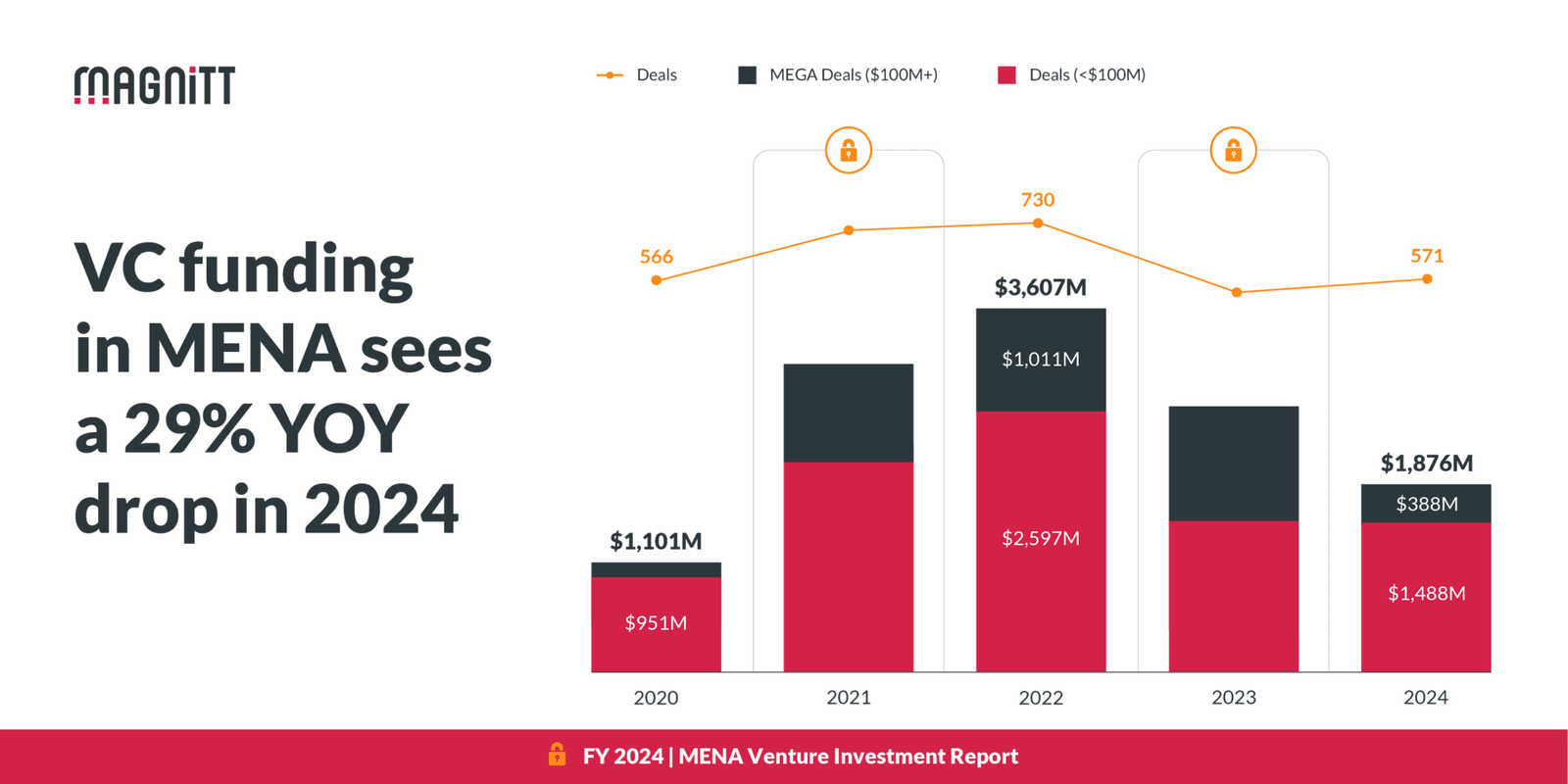

MENA’s Unique Position In 2024

In the Middle East and North Africa (MENA) region specifically, startups raised $1.9 billion—a significant drop compared to prior years but still higher than pre-pandemic levels in 2020. The MENA region also bucked the trend with a 7% year-on-year increase in deal volume, while nearly half of all investments fell within the $1-5 million range, highlighting a growing focus on early-stage deals.

Despite these positives, MENA, like other regions, saw a marked decline in late-stage funding, as international investors primarily concentrated on larger deals such as Insider’s $500 million round and Tyme’s $250 million Series D.

Sector Snapshots: Fintech Dominates, Others Rise

Fintech remained the dominant sector across EVMs, securing $3.9 billion in funding. This highlights the ongoing importance of fintech in regions where traditional financial systems are still underdeveloped. At the same time, other sectors like Advertising & Marketing and IT Solutions saw impressive growth, with funding rising by 181% and 30%, respectively, year-on-year.

What’s Next? Optimism For 2025

Philip Bahoshy, CEO of MAGNiTT, noted that while 2024 marked a low point in the funding cycle, there’s hope on the horizon. With global interest rates poised to decline over the next 6-9 months, he anticipates a stronger funding environment in 2025.

“The UAE, Saudi Arabia, and Qatar all saw increased deal activity year-on-year despite reduced capital deployment,” Bahoshy said. This trend, coupled with a growing investor base in MENA, suggests that international confidence in the region’s startup ecosystem is steadily rising.

Meanwhile, Tatsiana Zaretskaya, General Partner of Terra Cognita Ventures, notes the growing role of Saudi Arabia in the Mena region.

“In recent times, the startup ecosystem in the Middle East and North Africa (MENA) region, particularly in Saudi Arabia, has experienced a decline in funding. This trend is largely due to investors shifting their focus towards profitable ventures. Major entities like Saudi Aramco and the Public Investment Fund (PIF) have historically invested in early-stage, high-potential companies. However, some of these investments have not met performance expectations, prompting a strategic pivot towards businesses with proven profitability.

Despite this overall decline, Saudi Arabia has demonstrated resilience in its startup funding landscape. In the first half of 2024, the Kingdom secured 54% of the MENA region’s total funding, up from 38% during the same period in 2023. This was achieved with 63 transactions, marking only a slight 3% decrease from H1 2023, even as the broader MENA region experienced an 18% drop in deal activity.

For entrepreneurs operating profitable startups, Saudi Arabia presents a compelling opportunity. The market is substantial and relatively open, offering significant potential for internal growth and traction. Additionally, new funds have emerged from both the government and private sectors. Family offices and traditional investors, who may not have prior experience with startups or venture capital, are entering the ecosystem. These investors often expect annual returns, differing from the typical long-term horizons of venture capital investments. It may take several years for these investors to fully acclimate to the startup and VC landscape.

While there is a discernible shift towards funding profitable businesses in Saudi Arabia’s startup ecosystem, the Kingdom continues to lead the MENA region in securing substantial investments. This presents a favorable environment for profitable startups seeking higher funding opportunities compared to markets in the US or Europe.”