Startups are anything but a straight path to success—they’re a constant cycle of challenges, risks, and pivotal decisions. Uri Levine, co-founder of Waze (acquired by Google for $1.3 billion in 2013) and a seasoned entrepreneur, sees crises as an inevitable part of building a company. With experience on 20 boards and as an advisor to over 50 startups, he brings deep insight into navigating uncertainty. In the latest chapter of his best-selling book, Fall in Love with the Problem, Not the Solution, Levine offers a practical guide to helping companies weather crises and emerge stronger.

In his conversation on Lenny’s Podcast, Levine shares his insights on crisis management, the importance of decision-making with conviction, and why the most successful founders never give up.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

The Two Types Of Crises Every Founder Will Face

Crises come in different forms, but Levine categorizes them into two major types: cash crises and product-market fit crises.

A cash crisis arises when a company’s financial stability is suddenly jeopardized—whether due to the loss of a major customer, an investor pulling out, or unforeseen economic conditions. “If you lose half of your revenue overnight, you don’t have time to hesitate. You must act immediately,” Levine warns.

The second and even more dangerous type is a product-market fit crisis—when a company’s core offering is no longer relevant. “Regulatory shifts, new competition, or changing customer preferences can make your product obsolete overnight,” Levine explains. “If your product-market fit disappears, you have to go back to square one.”

In both cases, survival depends on swift and strategic decision-making.

Decision-Making Under Pressure: Why Speed Matters

Levine emphasizes that indecision is one of the biggest risks during a crisis. “Successful CEOs make decisions with conviction. If you hesitate, your team will sense it, and confidence will erode,” he says.

During times of uncertainty, leaders must quickly assess three key factors:

- What is being impacted? – Identify whether the crisis affects cash flow, product viability, or team morale.

- How long will the impact last? – Determine if this is a short-term setback or a long-term shift in the market.

- How much time do we have? – Calculate the financial runway and act accordingly.

“The worst thing you can do is wait too long. The longer you delay, the fewer options you’ll have.”

Levine warns.

Lessons from Waze: Surviving Google’s Direct Competition

Levine knows firsthand what it means to face an existential threat. When Waze launched, it was the only free navigation app offering turn-by-turn directions. But in 2010, Google entered the market with its free navigation service. Investors panicked, and many predicted Waze’s imminent collapse.

“Everyone told us we were doomed. Our investors suggested selling the company while we still could,” Levine recalls. Instead, Waze doubled down on its niche—daily commuters—while Google Maps remained a tool for occasional users. The team continued to iterate relentlessly, refining their real-time, crowdsourced traffic updates.

That persistence paid off. By 2013, Waze had built a dedicated user base that set it apart from Google Maps. That same year, Google acquired Waze for $1.1 billion. “We didn’t pivot—we just kept improving until we were undeniably better,” Levine says.

The Mindset Of Resilience: Why Founders Must Never Give Up

Levine highlights the role of luck in a startup’s success, noting that while skill and strategy matter, being prepared for unexpected opportunities is crucial. “Luck is opportunity meeting readiness. You can’t control when opportunities come, but you can make sure you’re prepared to seize them,” he says.

He also stresses the importance of transparency in leadership during crises. Employees are more likely to stay engaged if they feel informed and included. “If you hide bad news, they will find out anyway. It’s better to be upfront and show them you have a plan,” Levine advises.

For Levine, resilience is the defining trait of a successful entrepreneur. “Startups don’t fail because of one crisis—they fail when founders give up,” he says.

Even when external forces create setbacks, founders must keep looking for solutions. During the COVID-19 pandemic, several of Levine’s startups were hit hard, especially those in the travel industry. While some companies shut down, others found ways to pivot—shifting to local travel experiences or focusing on post-pandemic recovery strategies.

“You don’t prepare for a crisis because you don’t know what it will be. But you can build resilience by making fast decisions, keeping cash reserves, and refusing to give up.”

Levine explains.

The Art of the Pivot: When To Change Course And When To Shut Down

Levine provides an example from his startup Pontera, which faced regulatory challenges that forced it to reinvent its business model. Instead of shutting down, the team leveraged its existing technology and expertise to find a new market fit. “Sometimes, pivoting isn’t just an option—it’s the only way forward,” he explains.

Another key strategy for crisis survival is ensuring a long-term financial runway. Levine advises founders to maintain at least 18 months of cash reserves to weather unexpected downturns. “Having cash gives you time to react strategically instead of making rushed decisions,” he says.

Not every company survives a crisis, but the best founders know when to adapt. Levine advises entrepreneurs to ask themselves a critical question: “If I were starting today, would I build this company?”

If the answer is no, then founders must decide whether to pivot or shut down. A pivot requires leveraging existing assets—technology, talent, or market insights—to solve a different problem. If none of these assets provide a competitive advantage, shutting down and starting fresh may be the better option.

“Investors don’t want their money back—they want impact. If you have a strong vision for a new direction, chances are they’ll support you.”

Levine explains.

Conclusion

Crises are not anomalies; they are part of the entrepreneurial journey. The founders who succeed are those who embrace uncertainty, act with conviction, and adapt when necessary. As Levine puts it, “Building a startup is a journey from one crisis to the next. The key is to keep going.”

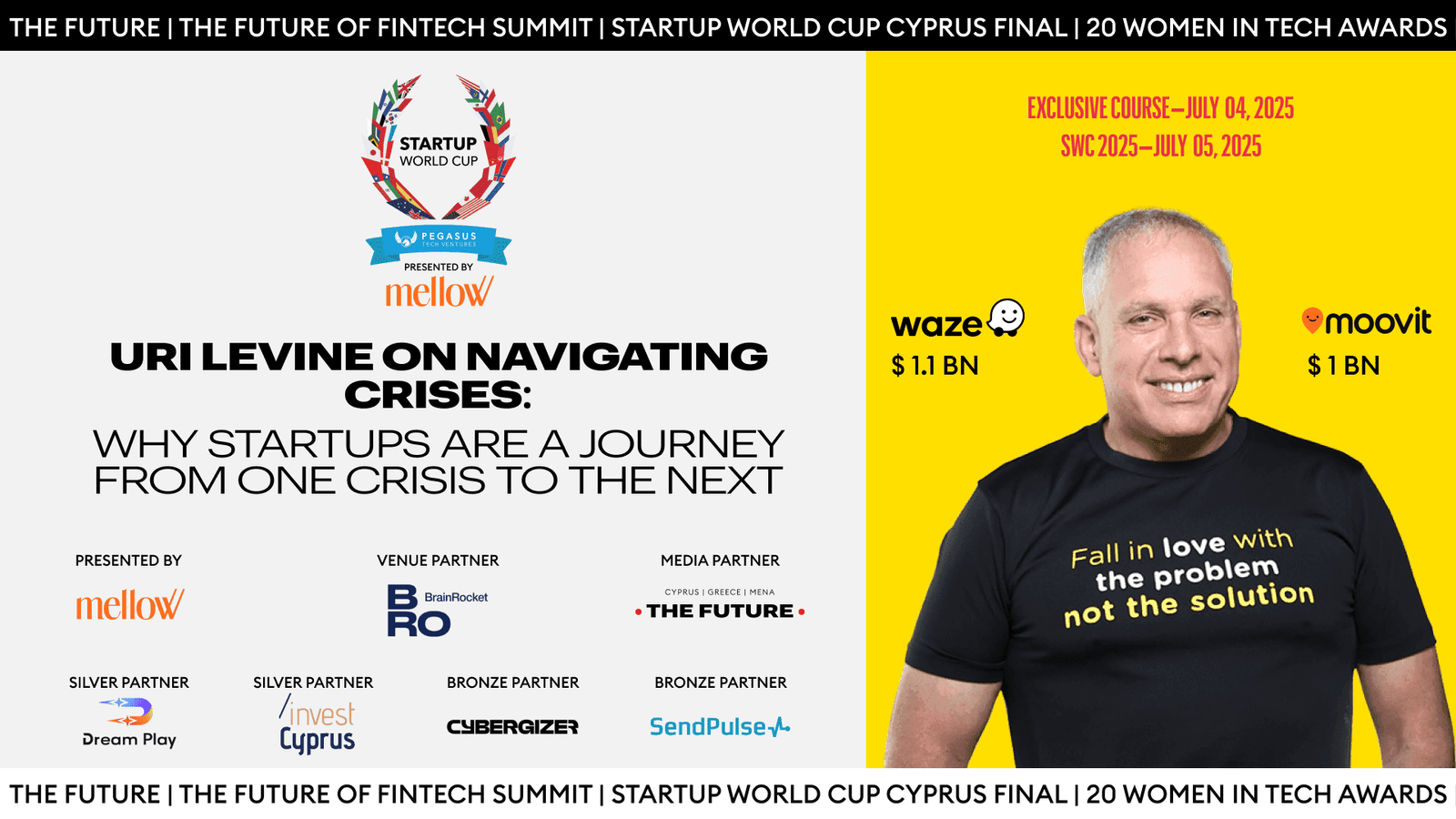

Partners of Startup World Cup Cyprus Finals 2025:

- Title Partner: Mellow

- Silver Partner: Dream Play

- Silver Partner: Invest Cyprus

- Bronze Partner: Cybergizer

- Bronze Partner: Sendpulse

- Venue Partner: BrainRocket

- Media Partner: The Future Media

- Global Organizer: Pegasus Tech Ventures

- Cyprus Organizer: Aivitam Ventures