When Navid Homayoun needed help relocating his business out of the UK, he reached out to international tax advisor Alina Kulikovska. What started as a one-off engagement confirmed what Alina Kulikovska had long observed in her practice: the global tax relocation process was slow, expensive, and overdue for a smarter solution.

“Clients spend two to three months just choosing a country and building a tax plan. It shouldn’t take that long,” says Alina.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

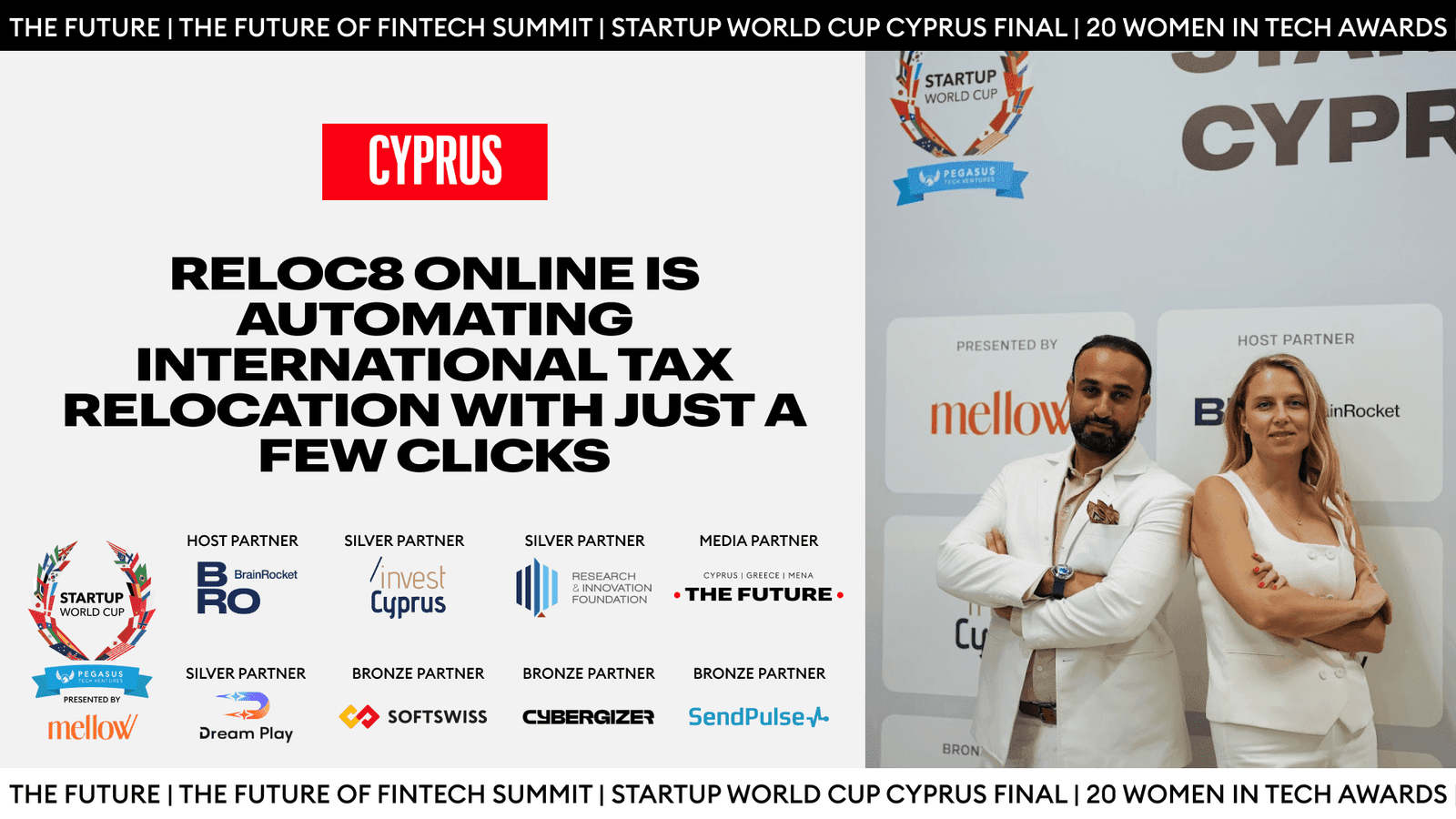

Today, the client-turned-business-partners are co-founders of RELOC8 Online, a Cyprus-based legaltech startup developing tools that help users navigate the increasingly complex landscape of international tax residency. Recently, they pitched at the 2025 Startup World Cup Cyprus Regional Finals in Limassol, joining nine other finalists competing for the chance to win a $1 million investment prize.

Their appearance at the Startup World Cup Cyprus comes at a time when global mobility is undergoing rapid change, and the demand for faster, smarter relocation solutions is growing just as quickly.

The $17.5 Billion Problem

Remote work and digital entrepreneurship have transformed global mobility. By 2024, more than 50 countries had launched digital nomad visas, which more than doubled the number available in 2021. These visas offer professionals the opportunity to relocate without giving up their jobs. For many, the draw isn’t just lower taxes (although this is a big plus), but the chance to improve their quality of life while working from more flexible, often sunnier locations.

Yet the rise in cross-border mobility has brought with it rising complexity for businesses. For instance, a 2024 Grant Thornton survey found that 49% of businesses cited tax and compliance risks linked to remote work arrangements. Individuals face similar challenges. A recent study estimated that tens of thousands relocate annually from high-tax jurisdictions, seeking better rates or stronger privacy protections. For these mobile professionals, the process is rarely straightforward. Legal fees can range from $10,000 to $30,000, timelines stretch into months, and tailored tax advice often takes 4–12 weeks to deliver.

Meanwhile, the global tax technology sector was valued at $17.5 billion in 2024, with forecasts projecting 12.1% annual growth through 2034. However, most existing platforms still rely heavily on manual consultation, leaving room for more automated and efficient solutions.

“Legal and tax experts spend hours on manual work: analyzing cases, preparing documents, and conducting repetitive consultations,” explains Alina Kulikovska. “This is inefficient for both sides. Add to that the human factor — no single expert can be fully knowledgeable about all relocation options or jurisdictions worldwide.”

This is where RELOC8 Online is looking to make a difference. In the words of Alina Kulikovska, “Our mission is both professional and educational — to empower individuals and businesses with accurate, practical, and accessible tools for global mobility and tax strategy.”

Making Relocation Clickable

RELOC8’s flagship product is the Destination Selector: an AI-powered tool that uses a 10-question quiz to instantly provide three tailored jurisdiction options that best match the client’s unique personal and financial profile.

“Most clients find a specialist through recommendations or online research and usually approach them with a specific country in mind,” says Alina Kulikovska. “But often, that choice is far from optimal. Important factors such as family situation, pets, climate preferences, lifestyle goals, and long-term financial planning are rarely considered in depth […] Some clients dream of a slow, mindful life in Bali; others need the high-paced infrastructure of Singapore or Dubai. Every case is unique — and should be treated as such.”

According to the CEO, with Destination Selector, finding your next tax relocation destination that fits your unique needs can be found in under three minutes. With this product, RELOC8 Online is trying to “save people’s time, spent on long consultations, strategy development, and inefficient decision-making, [and] lower the cost of tax relocation strategy services, making them more accessible without sacrificing quality.”

After receiving the client’s answers, the platform also offers them the option to purchase a comprehensive strategy and relocation plan, which includes:

- A detailed roadmap for exiting your current tax residency

- A step-by-step plan for acquiring new tax residency

- Jurisdiction-specific guidance for tax optimization

- Legal and compliance insights tailored to your situation

They also plan to offer a free downloadable checklist soon for each jurisdiction, which will be an invaluable resource for anyone researching their relocation options independently.

Popular destinations like the UAE, Portugal, Cyprus, and Singapore each offer different combinations of tax incentives, streamlined bureaucracy, and political stability. RELOC8’s algorithm helps users navigate these trade-offs systematically rather than through expensive trial-and-error consultation cycles.

From Beta to Business

Since launching the startup nine months ago, RELOC8 has attracted 120 client inquiries, seven of which have successfully converted into paid strategy engagements for tax relocation. While modest in number, these early adopters—ranging from digital nomads to startup founders—have provided valuable feedback used to refine the platform’s logic and interface.

“They usually come from the recommendation, or digital nomad and startup communities,” says Alina Kulikovska. This kind of early traction suggests that the platform is resonating with its target audience, particularly those seeking a faster, more transparent way to manage international tax planning.

While the company’s focus remains on direct users, the team is also exploring how the platform might be useful to legal and tax professionals. “We also consider B2B direction, where we will offer our platform to legal and relocation consultants,” she explains.

Spotlight Moment

The Startup World Cup Cyprus Regional Finals wasn’t the first time the founders pitched their startup to investors. Alina Kulikovska shares her reflections on climbing up onto that stage:

“We had already gained experience during our Demo Day at the Elevate Bootcamp accelerator. Still, I’ll admit — I was nervous before going on stage. But once I started speaking, the anxiety disappeared completely. When you truly believe in your product, understand your business inside out, and are involved in every process, presenting it to others becomes natural. You’re not reciting a pitch; you’re sharing something real.”

The experience proved to be more than just a pitch. The team walked away with the Audience Favorite Award, sponsored by SendPulse, which was granted based on live voting from attendees. RELOC8 ONLINE received a $5,000 prize, a clear indication of strong public interest and real-time traction with their target users.

“This experience once again confirmed that we’re moving in the right direction. We have a clear growth roadmap — and we’re steadily following it, step by step,” says Alina Kulikovska. “What became even more evident during the event is that our project truly resonates with people. The interest we received was not abstract — it was tangible. Many of those attending the finals were either going through or had already experienced relocation and tax residency changes themselves. They immediately understood the value of our AI-powered platform.”

Even during the live pitch, audience members opened the platform on their phones, explored its features, and began testing the Destination Selector in real time.

“Beyond the stage, we met fellow entrepreneurs, potential partners, and even investors who showed interest in RELOC8 ONLINE. The experience not only validated our vision — it pushed us forward with even more confidence.”

The Road Ahead

RELOC8’s ambitions travel far beyond helping individual users choose a tax-friendly country. The team sees their Destination Selector as the starting point for something much larger.

“We are building Destination Selector for the global market — and we’re confident that in the coming years, it will become an essential tool for anyone exploring relocation, tax optimization, business structuring, and cross-border planning,” says Alina Kulikovska.

The company’s long-term roadmap includes turning today’s semi-automated process into a fully intelligent system, one capable of generating tailored strategies for users based entirely on their profiles and objectives.

“Our goal is to transform the current consulting model into a fully automated system that can independently generate tailored strategic solutions,” she explains. “We are committed to reducing the waiting time for personalized relocation strategies from several months to just a few hours — without compromising quality.”

Affordability is just as critical as speed. The founders believe that relocation support shouldn’t be limited to the ultra-wealthy and global corporations. “We want to make this solution accessible and affordable for a wider audience,” they say.

Their next big step? An AI-powered assistant that offers human-like consultations.

“We’re working on an AI Avatar Assistant that will deliver real-time, intelligent consultations — combining automation with a human-like experience.”

Alina Kulikovska reveals.

Even as they pursue new technologies and scale their ambitions, RELOC8’s focus remains grounded in the same principle that started the company in the first place: delivering smart, personalized support for people navigating the complexities of global relocation.