In recent years, the FemTech industry has been garnering significant attention from investors worldwide. Defined as technology-driven solutions catering to women’s health and wellness, FemTech has emerged as a promising sector with vast untapped potential.

From menstrual tracking apps to fertility solutions, the FemTech market is expanding rapidly, driven by a convergence of technological advancements, changing demographics, and evolving societal attitudes towards women’s health.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

According to the Future Market Insights report, the global femtech market is expected to be worth US$ 27,956.4 million in 2024. For 2023, the value was tipped to be US$ 26,818.2 million. The market is projected to show an average growth over the period from 2024 to 2034, with a CAGR of 4.5%. By 2034, the size of the market is predicted to expand to US$ 43,406.1 million.

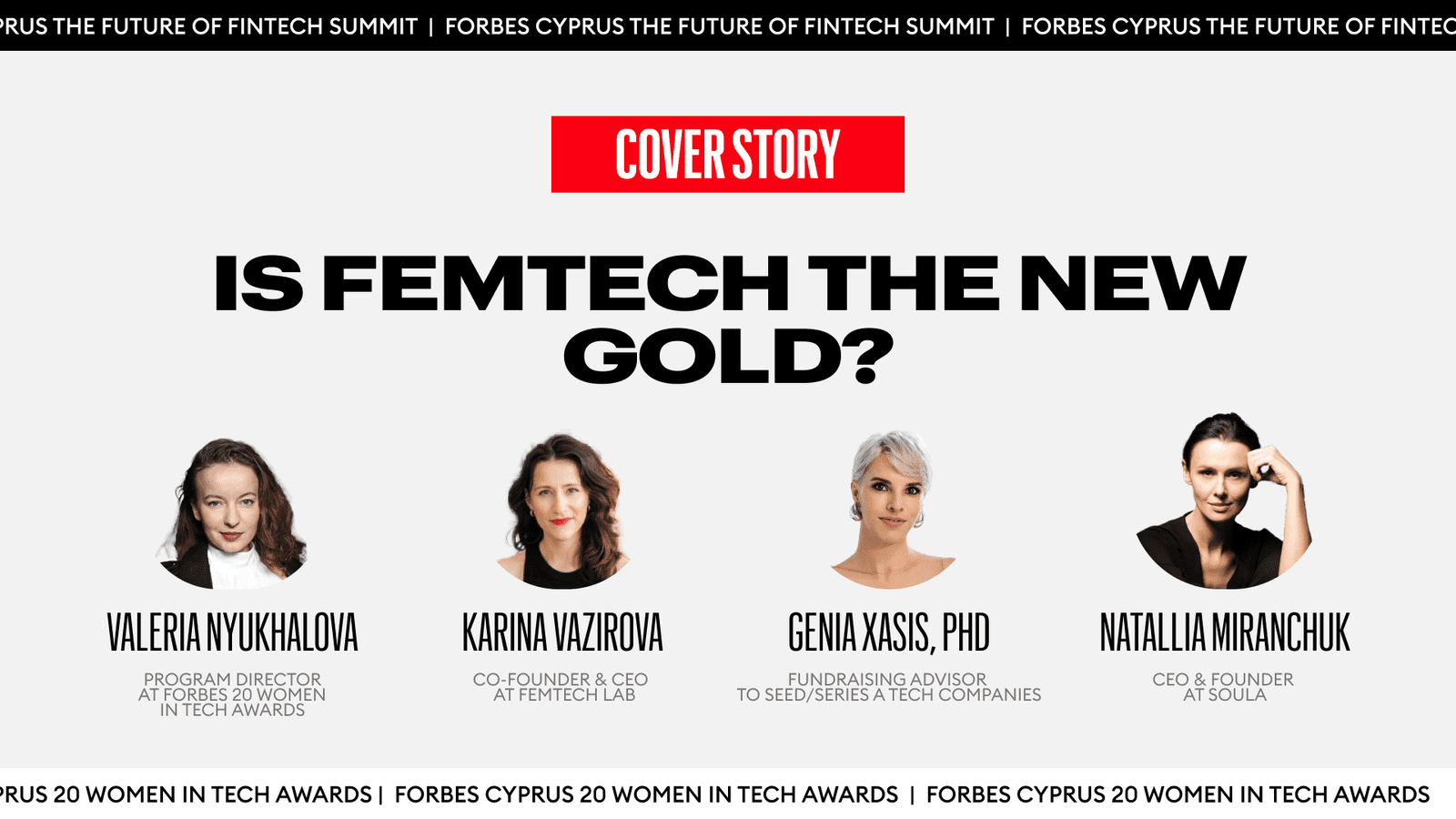

Valeria Nyukhalova, Program Director of the Forbes 20 Women in Tech Awards, shares the FemTech insights and together with industry leaders answers the question – is it going to be the new gold?

Karina Vazirova, Co-Founder & CEO, FemTech Lab:

“Women’s health and FemTech, like any other sector, is going through stages of maturity. It’s tricky to pinpoint one factor that would unlock growth. I think it’s easy to say more investment, but the reality is always more complex than that.

At FemTech Lab, we have seen waves of popular propositions and routes to market. Right now, we are seeing more interest from Insurance and founders are focusing more on reimbursement pathways, rather than B2C. The Insurance market is still making sense of women’s health and how to incorporate solutions effectively — it will be interesting to see how this evolves in the UK and Europe. This is just one example of how our sector is maturing and, alongside broader HealthTech, figuring its commercial dynamics.”

Riding the Wave of Innovation

The FemTech landscape is witnessing a surge in innovation, with startups leveraging cutting-edge technologies such as artificial intelligence, machine learning, and wearable devices to develop solutions that address a myriad of women’s health issues. Whether it’s empowering women to take control of their reproductive health, providing support during pregnancy and post-partum care, or tackling taboo subjects like menopause and sexual wellness, FemTech companies are pioneering transformative solutions that resonate with today’s digitally savvy consumers. For investors, the FemTech industry offers a compelling opportunity to capitalize on the intersection of technology and healthcare while championing female-centric innovations. With women increasingly taking charge of their health and demanding personalized, accessible, and stigma-free solutions, the market potential for FemTech is vast and largely untapped.

Genia Xasis, PhD, Fundraising advisor to seed/series A tech companies:

“The statistics show that there are only 2% of women-led companies applying for accelerators all over the world. Usually, it takes 3 months to finish the program and sometimes startups drop out on the way, and in the end, there are no female-founded companies at all. At the same time, there are just 10% of women check-writers — it means that we are living in a world where companies are built by men and with a male vision.

On the other hand, 80% of the decision-makers in the consumer market are women. When a couple is buying a car or a TV or something for the office, the woman is the one who is making the final decision. If more products are built with female vision and for women, companies will be richer, because we are more likely to purchase the products that were built for us, that we understand. That will release a solid amount of liquidity in the market, which is a success for everyone.”

Key Growth Drivers

Several factors are driving the growth of the FemTech industry and attracting investors’ attention:

- Rising Awareness and Demand: As awareness around women’s health issues grows and taboos diminish, there is a corresponding increase in demand for innovative solutions that cater to diverse needs, from reproductive health to menopause management.

- Advancements in Technology: Breakthroughs in areas such as wearable sensors, data analytics, and telemedicine are enabling the development of more sophisticated and user-friendly FemTech solutions, enhancing accessibility and convenience for consumers.

- Supportive Regulatory Environment: Regulatory bodies are increasingly recognizing the importance of FemTech innovations and streamlining approval processes, paving the way for faster market entry and commercialization.

- Shift in Healthcare Paradigm: With a growing emphasis on preventive and personalized healthcare, FemTech solutions align with broader industry trends, offering cost-effective and efficient alternatives to traditional healthcare models.

Navigating Challenges

While the FemTech industry presents promising opportunities, it also faces certain challenges that investors should consider:

- Regulatory Compliance: Navigating the complex regulatory landscape, especially concerning medical devices and data privacy, can pose significant hurdles for FemTech startups seeking market approval and scalability.

- Market Fragmentation: The FemTech market is highly fragmented, with numerous players vying for market share across different sub-sectors. Identifying standout companies with sustainable business models and competitive advantages is essential for investors.

- Consumer Adoption and Retention: Despite growing awareness, some FemTech solutions may face challenges in terms of consumer adoption and long-term engagement. Educating users and fostering trust is crucial for driving uptake and retention.

- Ethical questions: inclusivity and diversity in this sector are crucial for developing products that will benefit women’s health, especially for marginalized communities. Individual approaches to a person’s specific circumstances and needs should always win over a one-size-fits-all strategy.

Natallia Miranchuk, CEO & Founder, Soula:

“As a female founder during my journey with Soula, I realized that it’s really hard to work in a usually male-dominated business world: less trust, fewer investments, fewer unicorns and successful companies, built by women in general. It’s a circle we need to break through — like a question of the hen and the egg, in my opinion. The solution I found is building a really strong team: men and women combined, and asking them for help — that’s the trick. You have to be free, not afraid to ask questions, make mistakes and fail. And when you are looking for advice, men are usually eager to give it.”

Perspective femtech segments

According to Dealroom, the global femtech market is projected to grow to $60 billion by 2027, driven by increasing demand for personalized, convenient, and accessible healthcare solutions for women. Dealroom mapped 440+ femtech startups globally across 12 categories:

- Menstrual Care: Solutions catering to the physical, mental, and overall well-being of individuals experiencing menstruation throughout the various phases of the menstrual cycle. Femcare technologies such as cycle tracking applications, products like eco-friendly and sustainable sanitary pads, tampons, menstrual cups, and leak-proof underwear. Examples of such solutions include Ruby Love, Clue App, Flo.

- Reproductive Health and Contraception: Solutions designed to monitor a patient’s reproductive journey, offering guidance and resources regarding reproductive health, safe abortion care with confidentiality, and contraceptive methods, medications, or devices for pregnancy prevention. Additionally, it includes fertility solutions aimed at assisting patients in conceiving through medical interventions, surgical procedures, and assisted reproductive technologies such as intrauterine insemination (IUI) and in vitro fertilization. Examples of companies in this segment include Stix, Emme and Apricity.

- Pregnancy, Childbirth, and Nursing: Solutions aimed at assisting patients throughout the stages of prenatal care and childbirth, to enhance the health outcomes for both the mother and the newborn, while also addressing any post-partum complications. Examples: Elvie, Willow, Soula

- Family Care & Parenting: Solutions providing support and resources for parents and family caregivers, offering advice, tips, and technology to monitor the child’s growth and well-being. Tinyhood and Healofy are examples.

- Menopause: Solutions focused on enhancing the quality of life for individuals undergoing menopause, offering technologies to predict and manage menopausal symptoms effectively. Examples: Vira Health; Ourkindra.

- Sexual Awareness: Solutions promoting physical, emotional, mental, and social well-being concerning sexuality, intimacy, and sexual hygiene. These may include innovative devices for achieving sexual satisfaction, tools for STD prevention, testing, and treatment, as well as access to sex education resources. Company examples: Vella Bioscience; Dame Products.

- Oncology: Comprehensive solutions spanning from early cancer diagnosis to drug discovery, to prevent, monitor, and detect cancer. Examples include platforms like VARA and Gabbi. Examples: VARA; Gabbi.

- Pelvic Health: Solutions for issues related to pelvic and bladder health.

- Gynaecological Health: Solutions aimed at the maintenance and care of women’s reproductive organs. Examples: FemiClear; Evvy.

- Chronic Illnesses: Solutions aimed at testing, diagnosing, and managing chronic illnesses specific to women’s health: DotLab; Endodiag

- General Health & Wellness: Solutions offering clinical care, direct-to-consumer products, ongoing support for a spectrum of women’s health conditions, including digital health clinics and mental health clinics. Examples: Eucalyptus; S/O/S.

- Nutrition Health & Supplements: Solutions providing vitamins and supplements to support immunity and address nutritional deficiencies. Examples: Nutrafol; Care/of.

General Health & Wellness, Reproductive Health and Contraception, and Oncology have attracted jointly over US$ 4 billion in investment in recent years. Looking at the number of rounds, Menstrual Care is the third most funded segment. In 2022-2023 Reproductive Health and Contraception, General Health & Wellness, and Oncology are still the top segments both in funding amount and the number of rounds.

Karina Vazirova, Co-Founder & CEO @FemTech Lab:

“One of the biggest unlocks for the sector could be the emergence of new scientific research around women’s health conditions that have been under-diagnosed for many years. For example — endometriosis is a condition that impacts 1 in 10 women, and we still do not know the exact biological cause or way to diagnose it effectively. Another example is vaginal microbiome and health.

The more we understand the mechanisms of women’s health conditions, the more diagnostics become available. That in turn would create more opportunities for therapeutics. This research is happening more today, with women in STEM pushing it forward. In my view — it is only a matter of time now until we see that research cascade down into the venture space.

Social media influencers are starting to bring up women’s health through personal experiences. Doctors are becoming “clinician creators” — a term by YouTube that refers to medical professionals creating content for wider audiences. It will be interesting to see how that will impact awareness and consumer engagement in women’s health.

Two “cutting edge” topics I am watching closely are Ovarian Longevity and Psychedelic Therapy”

Conclusion

As the FemTech industry continues to evolve and mature, investors have a unique opportunity to support groundbreaking innovations that have the potential to transform women’s health and wellness globally. By backing visionary entrepreneurs, fostering collaboration across the healthcare ecosystem, and prioritizing user-centric design, investors can play a pivotal role in shaping the future of FemTech and unlocking its full societal and economic impact.

In summary, the FemTech industry represents not only a lucrative investment opportunity but also a chance to drive positive change and empower women to lead healthier, more fulfilling lives. As we look ahead, the potential of FemTech is limitless, and those who recognize and seize this opportunity stand to reap substantial rewards.