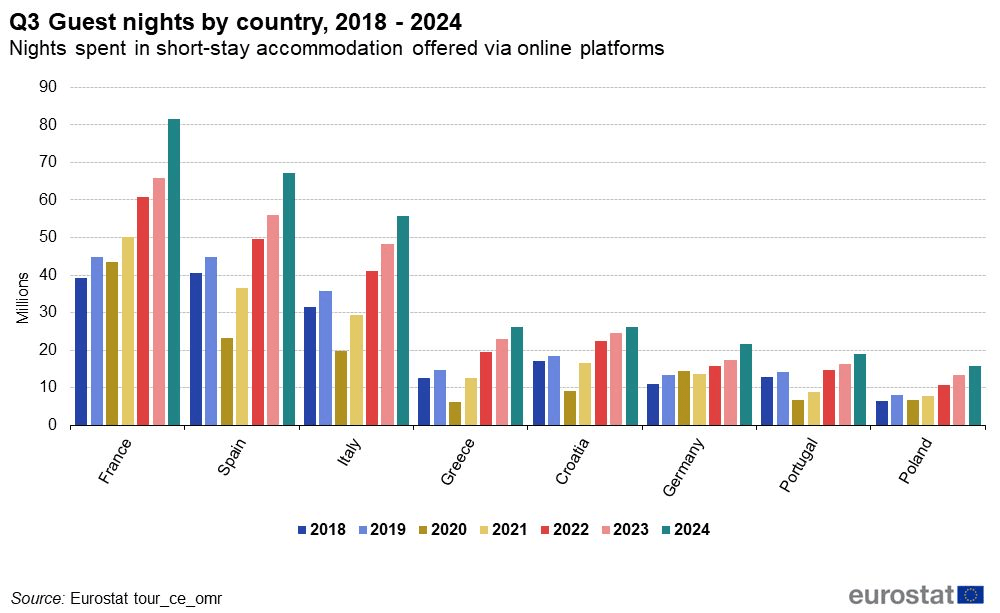

Greece has secured its spot as one of the eight most popular destinations for short-term rentals in the European Union, reflecting the increasing trend of platform-based tourism, according to Eurostat.

The country’s solid performance in the summer of 2024 aligns with a broader rise in short-term rental bookings across Europe. Eurostat’s latest data reveals an 18% year-on-year increase in bookings through platforms like Airbnb, Booking.com, and Expedia. Greece saw a 14.3% rise in overnight stays compared to 2023, contributing significantly to this growth.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

A Surge Across Europe

During the third quarter of 2024, short-term rental bookings across the EU reached 366.2 million overnight stays, with Greece accounting for 26.1 million of these, marking a 14.3% increase over the previous year.

The highest growth rates were seen in Malta (+40.9%), Germany (+26%), and Sweden (+24.6%). France, Spain, and Italy also experienced significant increases in bookings, with year-on-year growth rates of 23.8%, 20.2%, and 15.5%, respectively.

Strong Performance In The Summer Months

Across the EU, the third quarter of 2024 recorded robust growth in short-term rental bookings, with all three summer months showing impressive results:

- July 2024: 135 million overnight stays, up 16.4% from the previous year.

- August 2024: 152.2 million overnight stays, a 21.6% increase.

- September 2024: 79 million overnight stays, rising 14% compared to 2023.

Malta led the EU in August with a 41.4% increase in overnight stays, followed by Germany (+32.7%) and France (+29.9%). Smaller increases were recorded in countries like Croatia (+9.7%), Bulgaria (+12.2%), and Slovenia (+13.6%).

In Greece, August saw a 16% rise in overnight stays, further cementing its status as a top summer destination in Europe.

Greece’s Continued Popularity In Short-Term Rentals

Greece’s growth in short-term rentals is part of a larger upward trend seen across the EU. The country is now firmly positioned as one of the eight most sought-after destinations for short-term rentals, joining:

- France

- Spain

- Italy

- Greece

- Croatia

- Germany

- Portugal

- Poland

The Rise Of Platform-Based Tourism

The Eurostat report underscores a broader trend of growing reliance on platform-based tourism, with all eight top destinations surpassing pre-pandemic levels. Greece’s inclusion among these countries highlights its enduring appeal to travellers seeking short-term rentals.

This sustained growth not only underscores Greece’s importance in the European tourism market but also reflects the country’s ability to adapt to evolving travel preferences.