The Doers Company and Dubai Integrated Economic Zones Authority (DIEZ) have signed a strategic agreement to host the first Middle East edition of Doers Summit at Dubai Silicon Oasis in November 2025, connecting Europe, the Middle East, South Asia, and beyond.

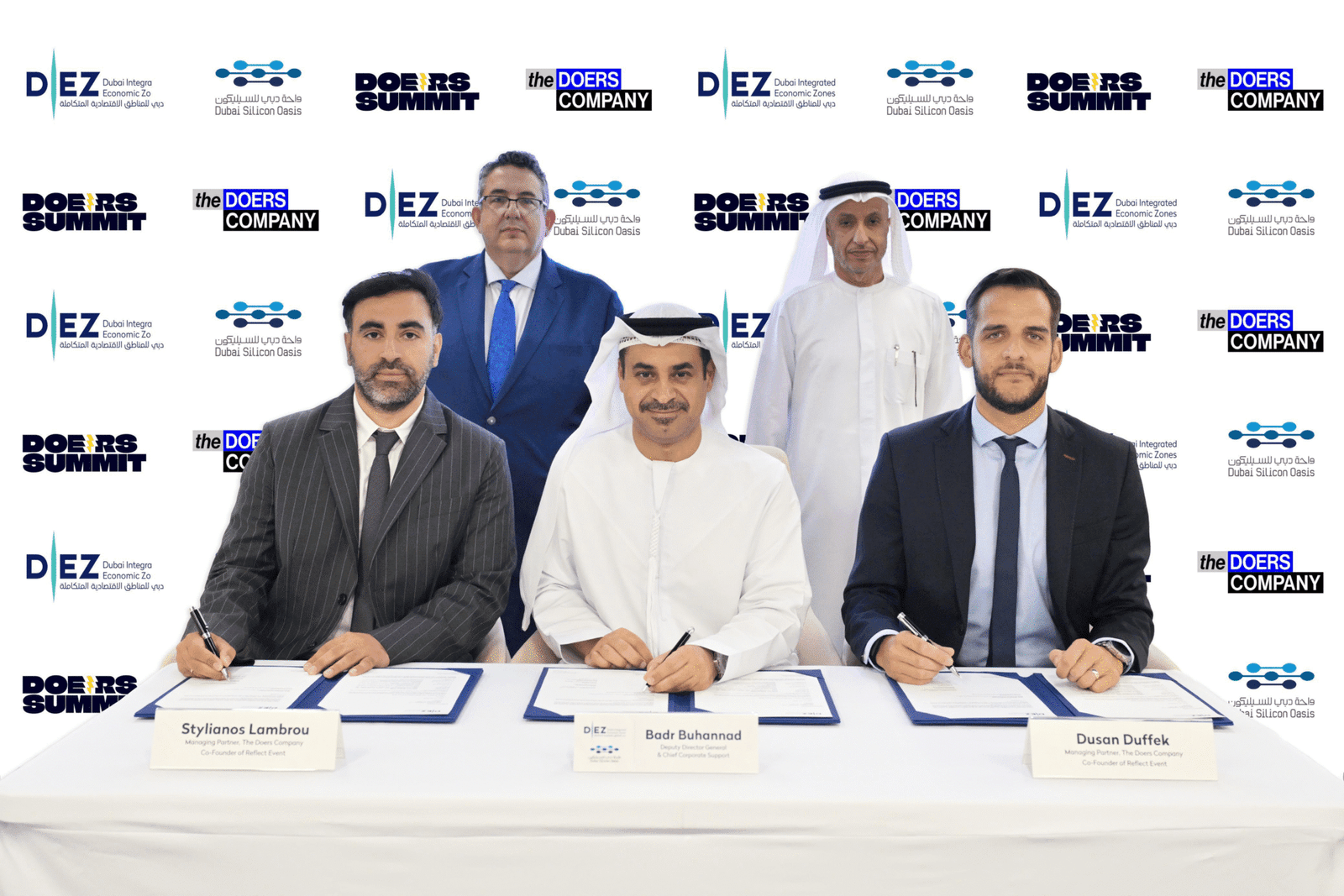

A signing ceremony was held in Dubai, attended by His Excellency Dr. Mohammed Al Zarooni, Executive Chairman of DIEZ, and Demetris Skourides, Chief Scientist for Research, Innovation & Technology at the Government of the Republic of Cyprus, underscoring government-level support for cross-border entrepreneurship and innovation.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

“Hosting this renowned Summit with The Doers Company aligns with Dubai’s Economic Agenda D33 and our commitment to positioning Dubai as a global leader in economic and digital growth,” said Badr Buhannad, Deputy Director General of Dubai Silicon Oasis.

The Dubai edition aims to bring together over 3,000 participants, including startups, venture capital funds, and ecosystem leaders, catalysing cross-border collaboration and capital access while maintaining the Doers Summit’s experience-led format of high-impact networking, curated content, and actionable deal-making.

Reflect Festival Becomes Doers Summit: A Unified Vision for Global Doers

This expansion to Dubai comes at a pivotal moment for The Doers Company, as it unifies all its flagship events under a single global brand.

Since its inception in 2018, Reflect Festival has grown from a local gathering in Limassol into one of Europe’s leading technology and entrepreneurship events, welcoming over 50,000 founders, investors, and operators across Limassol, Athens, and city meetups throughout Europe. Now, Reflect Festival evolves into Doers Summit, aligning a vision to create a single, global gathering of doers that fosters meaningful connections and builds ecosystems where it matters most.

“Reflect Festival was close to many of us, but evolving it into Doers Summit was about clarity of purpose,” says Stylianos Lambrou, Co-founder and CEO of The Doers Company. “Now, we are building a global gathering that creates the partnerships and opportunities shaping what’s next.”

The move to Dubai marks a natural progression, connecting Europe, the Middle East, South Asia, and beyond while maintaining the experience-led approach that defines Doers Summit: curated content, high-impact networking, and real-world deal-making.

“This is more than scaling an event, it’s scaling a movement,” adds Dusan Duffek, Co-founder and Managing Partner at The Doers Company. “We’re creating moments of convergence where regions connect, ideas collide, and real deals happen.”

With Dubai, Athens, and Limassol now under the unified Doers Summit banner, The Doers Company is laying the groundwork for a truly global ecosystem where doers can continue to learn, connect, and build what’s next, together.