Introduction

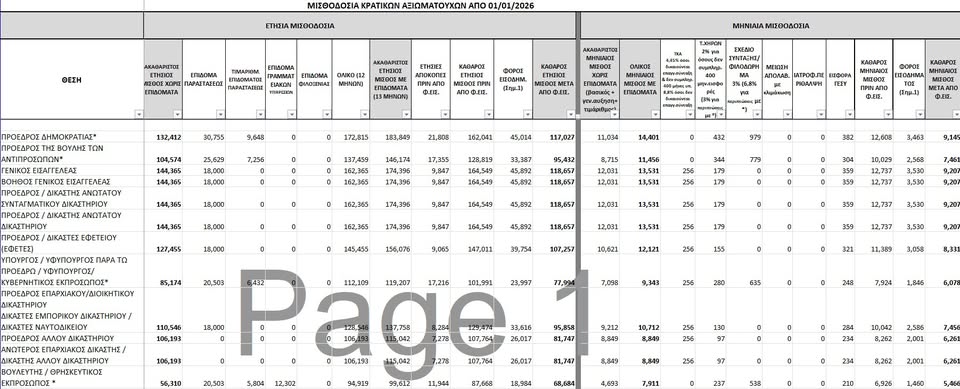

The General Accounting Office of the Republic has publicly released detailed salary breakdowns for all state officials, effective from January 1, 2026. This measure is part of an ongoing drive to strengthen transparency and accountability in public administration.

Clear Overview Of Total And Net Earnings

According to the official announcement, the periodic disclosure allows citizens a clear view of total monthly earnings (including allowances) and the net amounts received after statutory deductions and taxes calculated under the revised 2026 tax scales.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

Executives At The Pinnacle Of The Salary Pyramid

The apex of the salary structure is occupied by the President of the Republic, who receives a gross monthly salary of €14,401 and a net payment of €9,145. Following closely are the General Prosecutor, the Deputy General Prosecutor, and the President along with the members of the Supreme Court, with gross earnings of €13,531 and net pay of €9,207.

Compensation Within The Judicial And Legislative Sectors

Next in the hierarchy, the President and judges of the Court of Appeal command gross payments of €12,173 with net amounts reaching €8,331. In the legislature, the Speaker of the House is compensated with gross earnings of €11,456 and net take-home pay of €7,461. Similarly, other senior posts such as the Speaker of the Executive Council and the President of the Supreme Council of the State exhibit comparable scales. At the provincial level, judicial officers including those at the District, Administrative, Nautical, and Commercial Courts earn gross sums of €10,712 and net figures of €7,456.

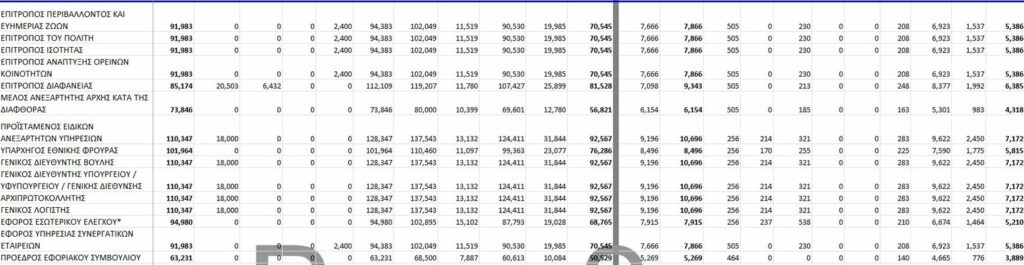

Senior Public Officials And Executive Appointments

Ministers, Deputy Ministers, and the Government’s Representative receive gross salaries of €9,343 accompanied by net payments of €6,078. Equally matched by their peers in senior administrative roles are the General Director of the President’s Office, the Commissioner for Transparency (netting €6,385), the Commissioner for Legislation, and the Commissioner for the Protection of Children’s Rights. Other essential roles such as the Department Manager and the Tax Inspector are remunerated with gross salaries of €8,996 and net amounts of €6,145, while the Data Protection Commissioner earns €8,921 gross with €6,214 net.

Members Of Parliament And Other Public Office Holders

Members of Parliament or Religious Representatives receive gross monthly earnings of €7,911 and net take-home salaries of €5,466. Other roles, including those holding positions on various presidential, environmental, and citizens’ committees, as well as the Cooperative Service Inspector, enjoy similar scales with gross earnings of approximately €7,866 and net amounts of €5,386. The lower tiers of the salary scale feature positions such as the Deputy Governmental Representative, whose earnings are €5,288 gross and €3,787 net, members of various committees (netting between €3,722 and €4,318), and the Press Office Director of the President’s Office, with compensation at €4,420 gross and €3,267 net.

Methodology Behind Net Amount Calculation

The General Accounting Office clarifies that the net amounts are derived solely from statutory deductions and the new 2026 tax scales. Additional deductions, exemptions, or other income sources, which might alter the final net amount, are not incorporated in these calculations. Detailed and updated information is published semiannually on the official General Accounting Office website under the “Salary Services / Salaries” section.

Download the complete salary disclosure file for state officials: State Official Salary Details (01/01/2026)

Conclusion

This comprehensive disclosure not only reinforces public sector transparency but also allows for a meticulous review of government spending on personnel. By providing clear data on the compensation scales across different branches of government, the initiative underlines an essential aspect of accountability in public administration.