When Alex Pavlov, founder of XONO, stepped onto the stage at the Cyprus Startup World Cup Regional Finals in July 2025, he wasn’t pitching just another fintech startup. He was presenting XONO, a next-generation financial infrastructure platform that is already powering over 2.5 million wallets with the capacity to process up to 10 million transactions daily.

Alex Pavlov positions XONO as the “Financial OS for Regulated Digital Assets,” a system designed to support banks, fintechs, and enterprises as they adapt to the growing demand for faster, borderless financial transactions.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

The Infrastructure Problem

XONO is a next-generation financial infrastructure platform enabling banks, fintechs, ecommerce, and gaming platforms to launch and scale compliant digital asset products, including wallets, stablecoin payments, tokenized services, and embedded finance. Built with banking-grade architecture and a modular design, XONO integrates seamlessly into existing legacy systems. It supports both own-license and direct licensing models, with regulatory approvals in progress across the EU, UK, and US.

“I was inspired by the needs of my current business for secure, scalable, and modern infrastructure,” Alex Pavlov explains. After the team spent seven years building software “on the fly” and adapting as they went, Alex Pavolov reached a breakthrough moment.

“I asked myself—what would the ideal setup look like for our needs? I couldn’t find it on the market. So, we decided to build it ourselves.”

That realization led to the creation of XONO, built to solve the industry’s most pressing adoption challenges. Rather than just another set of fintech tools, the platform combines regulatory compliance features, a crypto and stablecoin payment system, and wallet-as-a-service capabilities to address one of the industry’s biggest bottlenecks: digital asset adoption. By tackling interoperability with traditional banking systems and enabling companies to integrate faster and more securely, XONO helps financial institutions and consumer-facing businesses stay competitive as more users and companies worldwide adopt digital assets as a practical, borderless way to transact.

“We’re building banking-grade infrastructure for decentralized solutions,” Pavlov explains. “The main problem is integrating digital finance into traditional banking infrastructure—and vice versa. We’re creating a bridge between the past and the future.”

A Champion Partnership

XONO’s most tangible proof of concept came through an unlikely partnership with undisputed world boxing champion Oleksandr Usyk. Together, they co-founded Ready to Pay, rolling out one of the first stablecoin-powered Telegram cards designed for the sports community.

“We’ve received strong validation through our MVP partnership with Oleksandr Usyk,” Pavlov says. The collaboration extends beyond a single athlete—XONO now works with multiple boxing federations, sports merchandise marketplaces, and event organizers.

“At an international boxing tournament, participants received prize money in crypto. One of the most popular boxing gear manufacturers started accepting crypto payments—this is great real-world validation for us.”

This example of XONO working with the athletic community illustrates a larger business case of helping established brands integrate digital finance tools without the years-long learning curve. With XONO, that process can take as little as 3 to 6 months, not 5 to 7 years of trial and error.

Cyprus: The Fintech Hub?

Alex Pavlov’s decision to build XONO from Cyprus was deliberate. “Cyprus offers optimal tax conditions, transparent employment laws, solid infrastructure for employees’ families, and a strategically advantageous location in the region,” he explains.

The choice reflects Cyprus’s growing reputation as a fintech hub, particularly for companies operating at the juncture of traditional finance and digital assets. For XONO, which is pursuing regulatory approvals across the EU, UK, and US, Cyprus provides an ideal base of operations.

Lessons from the Startup World Cup Experience

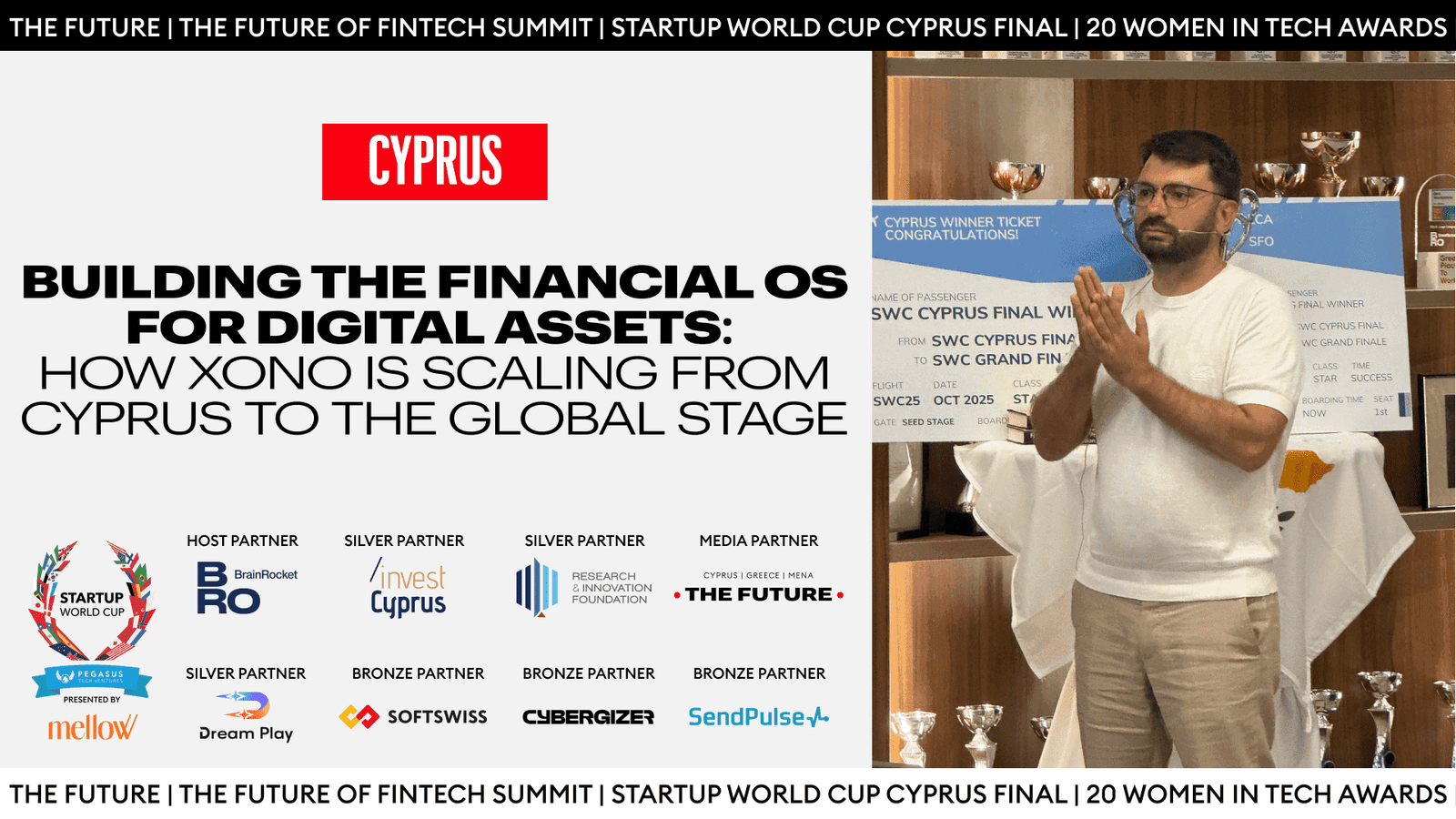

XONO was recently selected as a finalist in the Cyprus Startup World Cup Regional Finals, part of a global competition where startups pitch live for a chance to represent their country at the Grand Finale in San Francisco.

“For me, it was a real challenge—a competition, primarily against myself,” Alex Pavlov admits. “I was testing my ideas, plans, and even illusions.”

The experience provided valuable feedback that’s already feeding into XONO’s strategy. “I was constantly reflecting, listening to other founders and speakers, and receiving feedback from the jury—identifying where we need to improve and what we should focus on,” Pavlov recalls.

He singles out judge Uri Levine for particularly meaningful feedback:

“His perspective completely changed how I view many things.”

Beyond DeFi

Unlike many fintech startups chasing the lending or credit space, XONO has chosen a more targeted approach. “Our focus,” Alex Pavlov explains, “is on market segments where our product brings immediate value—and where we already have relevant contacts and use cases.”

Those segments include boxers and boxing associations, gaming platforms, real estate developers, and financial institutions, which all industries where XONO’s Wallet-as-a-Service solution with integrated crypto processing can seamlessly connect to existing systems.

The company’s immediate priorities reflect this focused approach. “Right now we’re focused on refining our company strategy—narrowing in on the core problem we solve and the audience we serve,” Pavlov concludes.

Looking Ahead: Infrastructure as Competitive Advantage

For a former DJ who found his way into fintech through determination and innovation, Alex Pavlov has built something remarkable: a platform that doesn’t just solve today’s integration challenges but provides the foundation for tomorrow’s financial innovations. As digital assets become increasingly mainstream, XONO’s banking-grade infrastructure may well prove to be the bridge the industry needs between traditional finance and its digital future.