TheSoul Publishing, a global leader in digital media and content creation services, recently announced the acquisition of a majority stake in Mediacube, a certified partner of YouTube and Meta that offers fintech solutions to nearly ten thousand creators across 130+ countries.

Over the last decade, Mediacube has become a game-changer in the creator economy and a market standard for creator finances. It provides tools that empower creators to effortlessly manage and maximize their earnings on YouTube and Facebook. The offering includes flexible payouts, early payments, and creator advances.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

In an exclusive interview, Mediacube CEO Michael Bychenok shares his company’s journey.

Could you take us back to the beginning – how did Mediacube start, and what was the journey like moving from the CIS market to serving a global creator audience?

The Mediacube journey began in 2015 as a local YouTube MCN, aimed at serving a regional market of YouTube creators, including those from CIS countries. It soon became clear that our primary strength was in IT and product development. We recognized that our entry into the international market needed to be driven by a strong product that could innovate within the YouTube sector. This led us to create MC Pay – a financial app designed for creators. We were the first company to launch a product offering flexible money management in the creator economy, enabling us to grow and expand into international markets rapidly.

To illustrate our international growth, over 90% of our clients were initially from the CIS, but by 2024, that number has decreased to less than 30% of our total client base.

What is Mediacube’s business model, and how has it evolved as the company expanded into new markets and engaged a global creator base?

We have two core business models.

The first is the Revenue Share model, where creators share a percentage of their earnings in exchange for a range of services we offer, such as technical support, copyright protection, content optimization, design, and more.

The second model is Pay as You Go, where creators pay based on the rates for financial solutions offered by MC Pay. For example, this includes advances for several months ahead, allowing creators to plan ahead and manage their finances effectively.

Mediacube is known as a game-changer in the creator economy. What were some pivotal moments in the company’s journey that helped shape this reputation?

The most transformative game changer in our journey was being the first to implement daily payouts based on predictions from YouTube Analytics. To bring this idea to life, we used our own capital. This innovative approach has created significant demand among creators.

Another key turning point for us was entering the B2B market. Two years ago, we decided to partner with other MCN businesses and provide them with MC Pay as a SaaS solution. We offer them our complete software for back-office operations, which includes report processing, payments, discovery tools, and much more. Their creators can now use MC Pay and access all the same financial products as Mediacube creators. To incentivize our B2B partners, we share a portion of the fintech revenue with them. This was another innovative move, as MCN businesses had not previously launched joint projects of this scale, and we were the first to do so.

In summary, the key factors behind our success are a strong product, timely innovations, and efficient execution.

What challenges did Mediacube face in scaling to over 130 countries, and what strategies did you employ to overcome them?

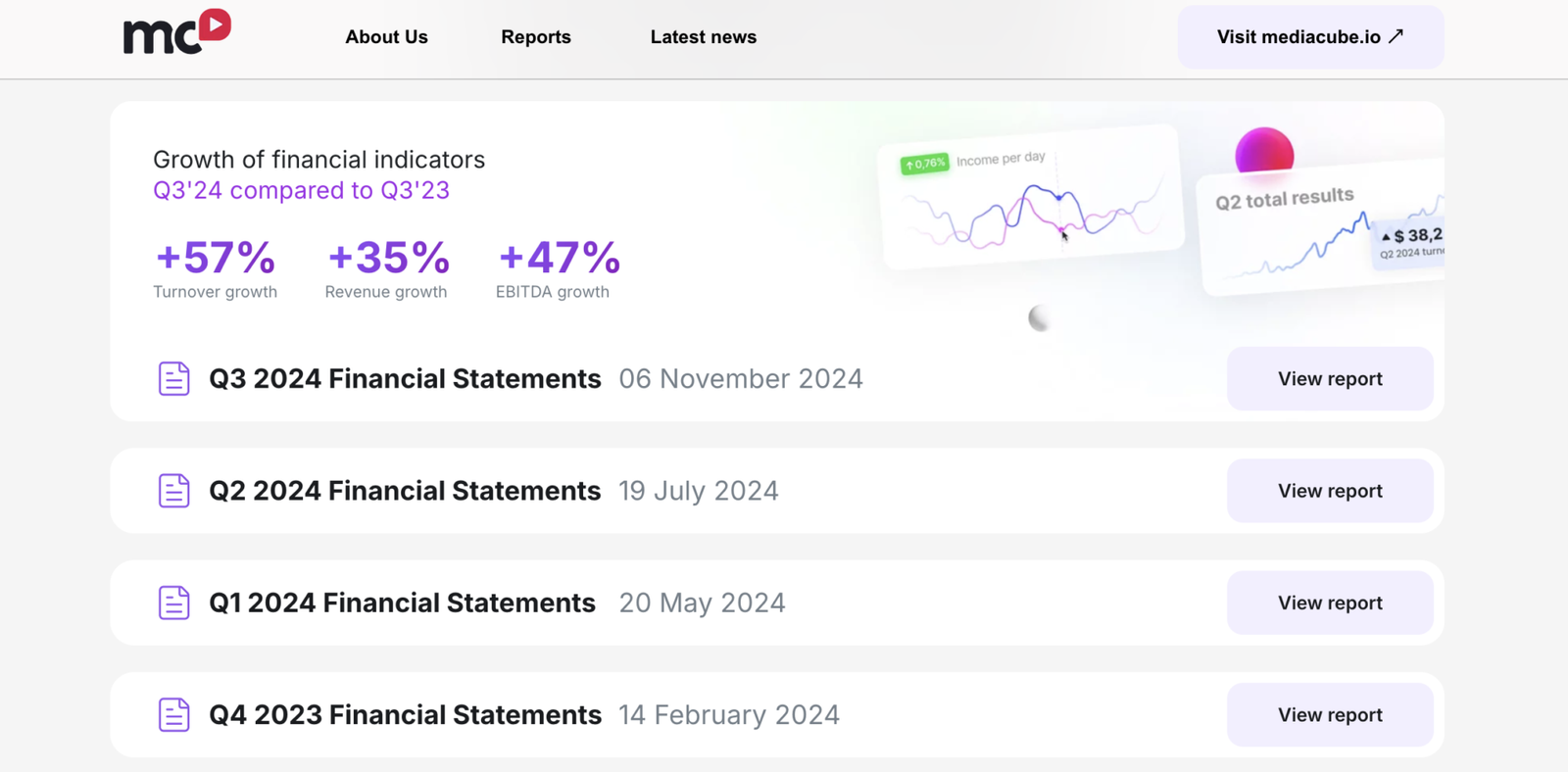

As Mediacube expanded into the global market, we faced several challenges, particularly in maintaining creator trust. Mediacube is a company that creators trust with their earnings. We understand that to cultivate this trust, transparency must be at the heart of everything we do. That’s why transparency is our core value. We are committed to publishing financial reports quarterly and regularly updating our clients on our financial health, product roadmap, and strategic initiatives.

This proactive approach not only strengthens our reputation but also reinforces the trust-based relationships we have built with creators. Moreover, our dedication to open communication has enabled us to scale globally. By keeping our creators informed and engaged, we foster long-lasting partnerships that drive mutual success and help us navigate the complexities of global expansion.

Mediacube raised a private equity round with Zubr Capital in 2019. Could you share how much was raised and what the ownership structure looked like after that round?

While I can’t share specific numbers or ownership details from our 2019 funding round, I can tell you that Zubr Capital held a minority stake in Mediacube, which was a significant partnership for us moving forward.

(According to our information The Soul Publishing bought out Zubr Capital’s stake – editor’s note)

What role did Zubr Capital play in Mediacube’s growth following the investment, and what were some of the goals achieved with their backing?

Zubr Capital invested in the company at a very early stage, and it’s important to note how much Mediacube has evolved since then. At the time, I was young and navigating my first business venture, and Zubr Capital played a pivotal role in that journey. They provided invaluable support in establishing crucial business processes right from the start by organizing our Board of Directors and developing effective decision-making frameworks. In addition to that their expertise in creating a clear P&L and budgeting all expenses provided us with a focused financial strategy. Furthermore, they assisted in setting up HR processes and crafting effective incentives for our managers, fostering a motivated team.

Zubr also provided critical insights into structuring our legal framework, which is vital for a company like ours involved in global payments.

Overall, Zubr Capital’s investment and expertise have been essential to our growth. Their support allowed me, as an entrepreneur, to build effective processes early on, leading to significant achievements.

Mediacube recently made its financial statements publicly accessible. What inspired this level of transparency, and how does it align with the company’s broader values?

As I mentioned earlier, transparency is a key value for our company. If we want to build trust with our clients, being open and honest is essential. I’m also proud that we have a track record of consistent growth each year, both in revenue and profit. These results show how hard our team works, and I think it’s important to recognize our achievements and highlight how well we meet our goals.

Finally, when we focus on transparency, it helps us build strong, trusting relationships within our team, so everyone knows their role in the big picture.

Looking forward, I understand that Mediacube might become a public company someday, and it’s a good idea to think ahead.

How will this acquisition impact Mediacube’s team? Will there be any structural changes, and what can team members expect moving forward?

This collaboration emphasizes teamwork without fully merging our teams. Some departments have overlapping functions, and these teams will now operate as a single business unit toward common goals to achieve shared results. However, other teams will remain distinct while working toward shared success, ultimately benefiting our clients and partners in innovative ways.

With TheSoul Publishing’s technology now in the mix, how do you envision the combined strengths of both companies benefiting creators?

Advantages of Mediacube include MC Pay technologies, convenient money management, and a variety of financial services. TheSoul excels in delivering highly efficient content production through automation at every stage – from idea generation and scriptwriting to pre-production planning, content production, and publishing. Together, these strengths can form a unified ecosystem that supports creators from the initial concept to effective financial management.

In your experience, what are some of the biggest financial challenges currently facing creators, and how does Mediacube help address these?

I believe there’s a growing demand for creators to secure funding for their projects, yet traditional banking hasn’t fully embraced the creator economy. This gap often leaves many creators facing challenges in accessing the credit products they need.

At Mediacube, we’re dedicated to bridging this gap by providing a swift and seamless financial solution for creators. We prioritize two essential factors: the quality of the content and the creator’s income history. Our product, Advances, has quickly become a favourite among creators for its accessibility and ease of use.

One of our standout advantages is our speed. In many cases, we can go from the initial inquiry to issuing the advance in just a couple of hours.

With Advances, creators can reinvest in their projects, driving their income growth organically and more rapidly than ever before.

What trends are you observing in creator demands, particularly on platforms like YouTube and Facebook, and how is Mediacube evolving to meet these needs?

Short-form content is becoming the most popular format, so creators are changing their strategies to keep audiences engaged. In collaboration with TheSoul, we’ve launched a new initiative called ShortsPay+. This initiative aims to promote our musical artists by encouraging our creator partners to use their tracks in their Shorts. As an incentive, we pay creators to promote our artists’ music, helping make their tracks more recognizable and popular on Shorts. This approach brings value to everyone involved: musical artists benefit from the viral promotion of their tracks, and creators earn additional income.

In summary, this is an exciting time for the creator economy. We are proud of our growth over the past decade and the trust we’ve built with content creators globally. And now, as we combine our expertise and strengths, we look forward to an inspiring, collaborative, and successful future with TheSoul.

The company refused to provide data for the deal, so The Future Media asked an independent investment analyst Denis Efremov (Principal at R136 Ventures), to evaluate the deal.

The analyst mentioned “The company showed good financial traction. They dropped by 22% and 37% in revenue and EBITDA, respectively, in 2022, but managed to recover growing by 54% and 107% in 2023 and still growing by 34% and 81% in 2024, respectively in revenue and EBITDA. They showed $12M in revenue for 9M in 2024 and an ARR of $14M in Q3 2024.

Running a quick peer analysis with Pitchbook gives us that for the M&A deals the multiple could be from 2x to 4x revenue and from 10x to 23x EBITDA (ranging from the median to a top quartile level).

So based on these numbers, the value of the company could be as high as $150-160M, but based on where the markets are, the sector and the balanced approach of the acquirer, I believe the range could be $50M-100M with most likely valuation to be at the lower end of $60M-$75M.“