As life satisfaction levels fluctuate across Europe, Cyprus stands out with a notable increase in its citizens’ happiness scores. With a rise from 6.2 to 7.5 over the past decade, Cypriots are now among the happiest in the European Union. But are they the most satisfied? This article takes a closer look at the countries leading the life satisfaction rankings, including the surprising trends in Cyprus and Greece, as well as the challenges faced by traditionally high-ranking nations like Denmark and Sweden.

Happiest Countries In The EU

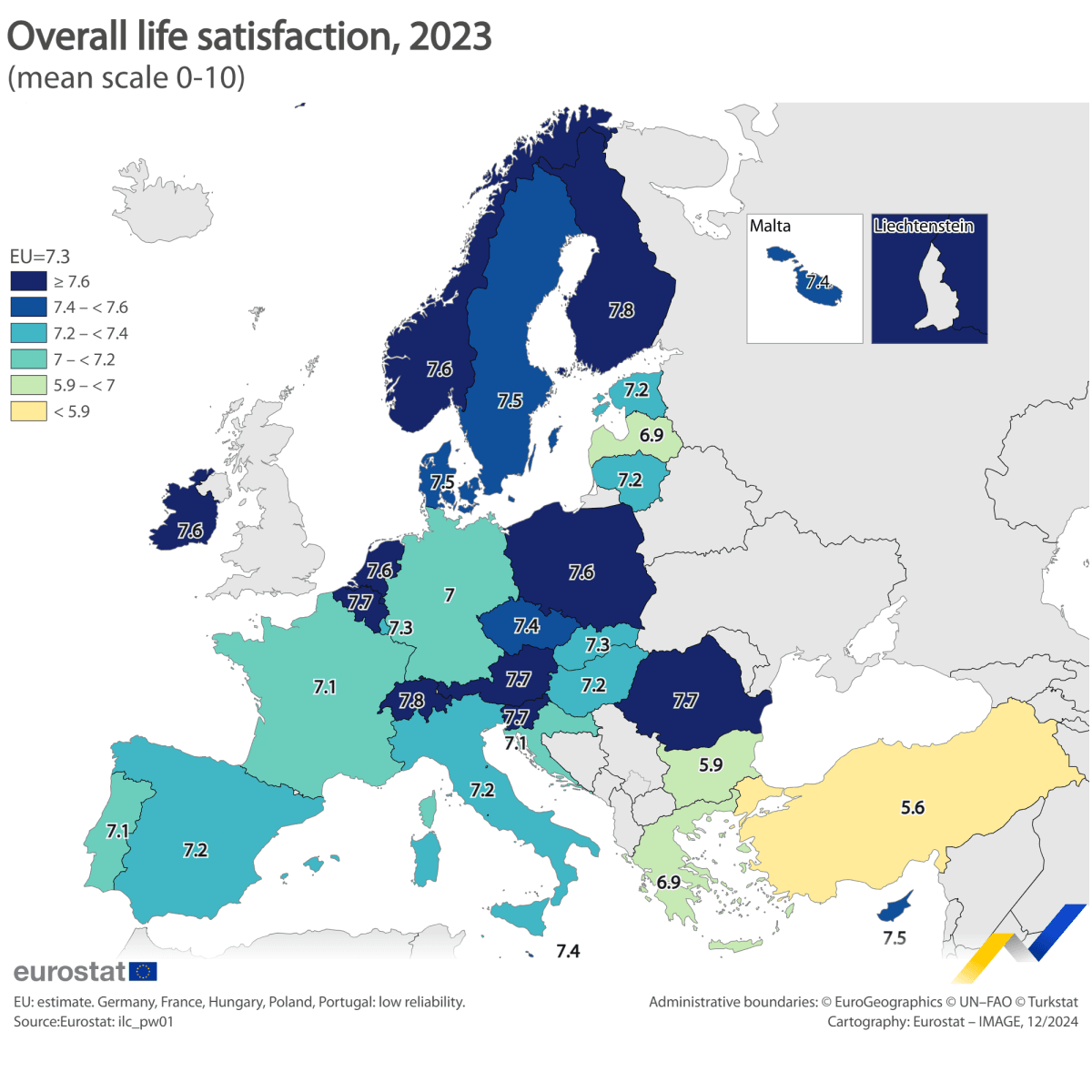

Finland leads the pack with a score of 7.8, followed by Belgium, Austria, Romania, and Slovenia, each with a score of 7.7. These countries consistently top the life satisfaction rankings, with strong social welfare systems, high-quality healthcare, and good work-life balance contributing to their citizens’ well-being.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

Countries With Declining Satisfaction

Denmark and Sweden, historically known for their high levels of happiness, have seen noticeable drops in satisfaction. Denmark’s score decreased from 8.0 to 7.5, and Sweden dropped from 7.9 to 7.5 over the past decade, reflecting growing concerns about societal pressures and changing economic conditions.

Countries With Rising Satisfaction

In contrast, Cyprus and Greece stand out for their improvements in life satisfaction. Cyprus has made a remarkable jump, increasing from 6.2 to 7.5, while Greece has risen from 6.2 to 6.9. This uptick can be attributed to economic recovery and an improvement in quality of life over recent years.

The Least Satisfied: Bulgaria

Bulgaria ranks at the bottom of the list with a score of 5.9, making it the least happy country in the EU. However, even Bulgaria has seen some improvement, increasing from 4.8 to 5.9 in the past decade.

While the life satisfaction survey focused on a simple 0-10 scale, the EU is working towards a more nuanced definition of happiness, moving beyond GDP measures. The European Commission has identified “8+1” criteria to better define the quality of life, which includes material living conditions, employment quality, health, education, leisure, social interactions, safety, governance, and the overall life experience.