The rise of remote work has blurred the lines between business and leisure, fueling a trend known as “workations.” Professionals are increasingly seeking destinations that offer seamless connectivity, affordable living costs, and a dynamic environment to balance productivity with cultural exploration.

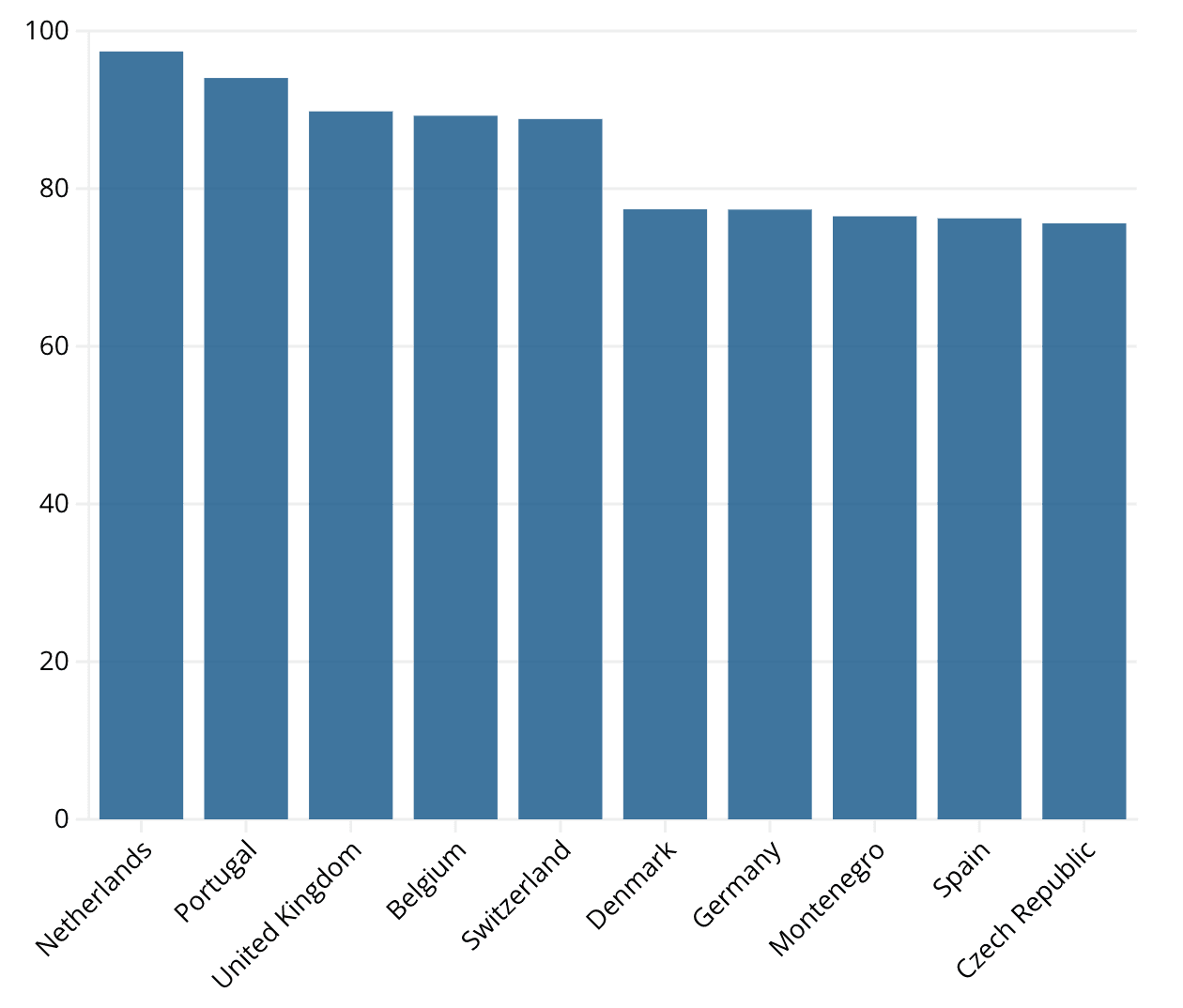

The Best Countries For Workations

In Europe, the Netherlands, Portugal, and the United Kingdom stand out as prime locations for remote workers. Portugal leads in public Wi-Fi density, offering thousands of free hotspots across major cities, making it an attractive option for digital nomads. Meanwhile, Denmark ranks highest for internet speed, ensuring seamless video calls and uninterrupted workflows.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

For those prioritizing collaborative spaces, the UK boasts the most developed coworking infrastructure, with hundreds of spaces catering to professionals in need of an office-like setup. Montenegro has also emerged as a hidden gem, thanks to its low cost of living and reliable connectivity, making it an appealing option for budget-conscious remote workers.

The Hidden Costs Of The Workation Boom

While the flexibility of remote work has opened new possibilities, it also presents challenges—particularly in countries already struggling with overtourism and rising living costs. Spain, which ranks among the top workation spots, is experiencing mounting pressure as short-term rentals surge, exacerbating the housing crisis. In the past decade, rents have doubled, driven by real estate speculation and a shortage of affordable housing.

The strain on local economies has led to growing tensions. Earlier this year, mass protests erupted across 40 cities in Spain, with demonstrators calling for stricter housing regulations to combat soaring costs. As the demand for work-friendly destinations continues to rise, European cities face the challenge of balancing economic benefits with the need to protect local communities from the unintended consequences of the remote work revolution.