Europe’s high-skilled workforce is showing a stark geographic split. According to Eurostat, about 80 million EU workers—roughly 44% of those aged 25 to 64—are highly skilled, encompassing managers, technicians, and knowledge professionals. However, the distribution of this talent is anything but uniform.

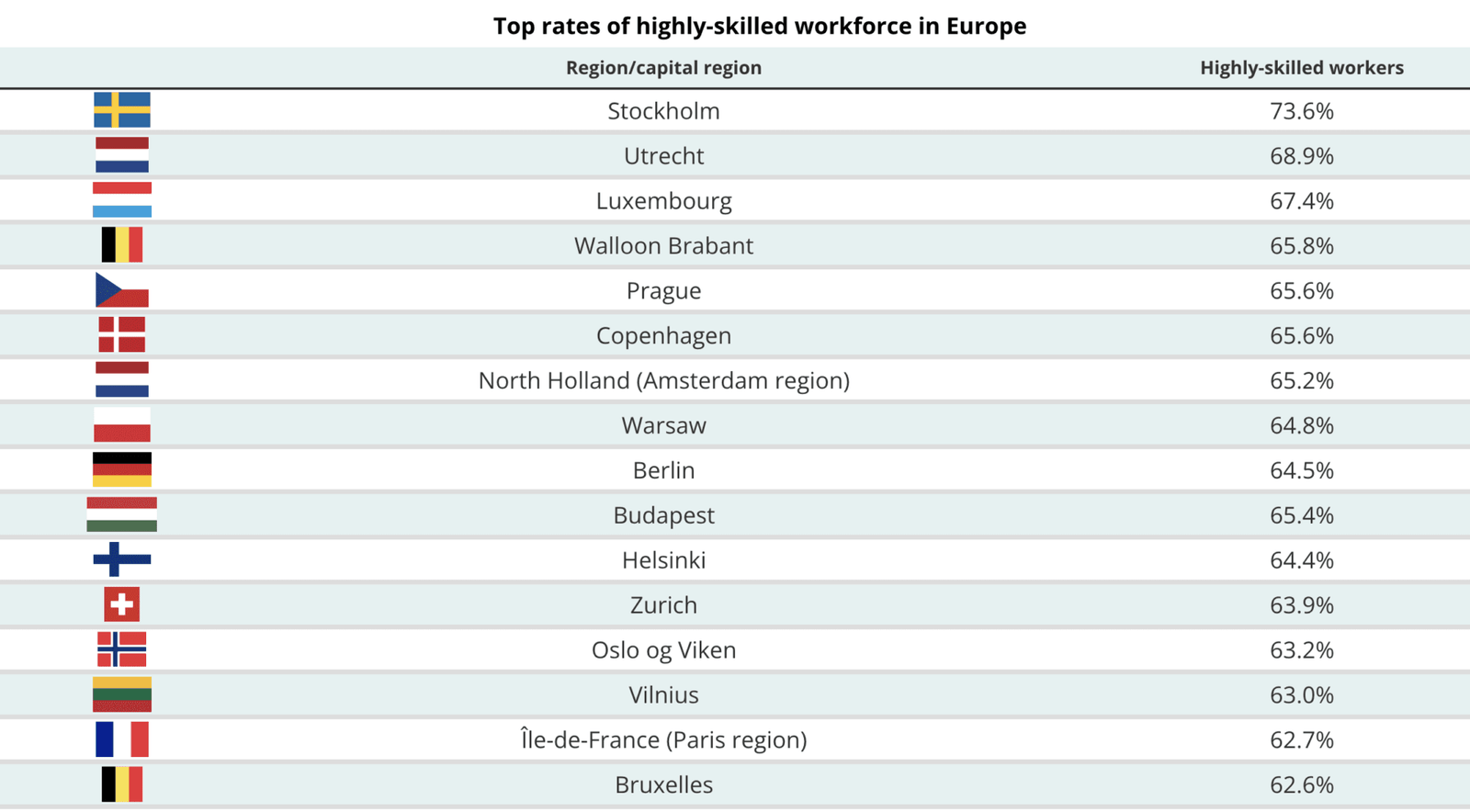

Across the continent, capital and major urban centers are the magnets for top-tier talent. Northern European capitals are leading the charge: Stockholm tops the list with a remarkable 74% share of highly skilled workers, followed by Utrecht at 69%, Luxembourg at 67%, and clusters in Belgium’s Brabant Wallon, Copenhagen, and Prague, all hovering around 66%. These regions are thriving hubs of innovation and expertise, where robust economic ecosystems continue to attract and nurture a competitive workforce.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

In contrast, rural areas and former industrial heartlands—particularly in southeastern Europe—are struggling to keep pace. In 24 EU regions, less than one-third of the workforce is highly skilled. Regions such as Sterea Elláda (Central Greece) report a mere 21.8%, while the Ionian Islands and Romania’s Sud-Muntenia stand at 22.3% and 22.8% respectively. This uneven distribution highlights significant challenges for economic development and competitiveness in these areas.

The data underscores a critical takeaway for policymakers and business leaders alike: the future of Europe’s economic landscape will be heavily influenced by the ability to bridge this talent gap. As northern capitals continue to lead in innovation and skill, southeastern regions face an urgent need for strategic investments and initiatives aimed at elevating their human capital.

In a rapidly evolving global economy, understanding and addressing this talent divide is not just an economic imperative—it’s a blueprint for sustainable growth and regional balance across Europe.