Artificial intelligence has taken the investment world by storm, with venture capitalists flocking to fund AI-driven startups at unprecedented levels. In stark contrast, the broader tech landscape has seen a decline in funding, highlighting the increasing dominance of AI in the venture capital sphere.

Key Facts

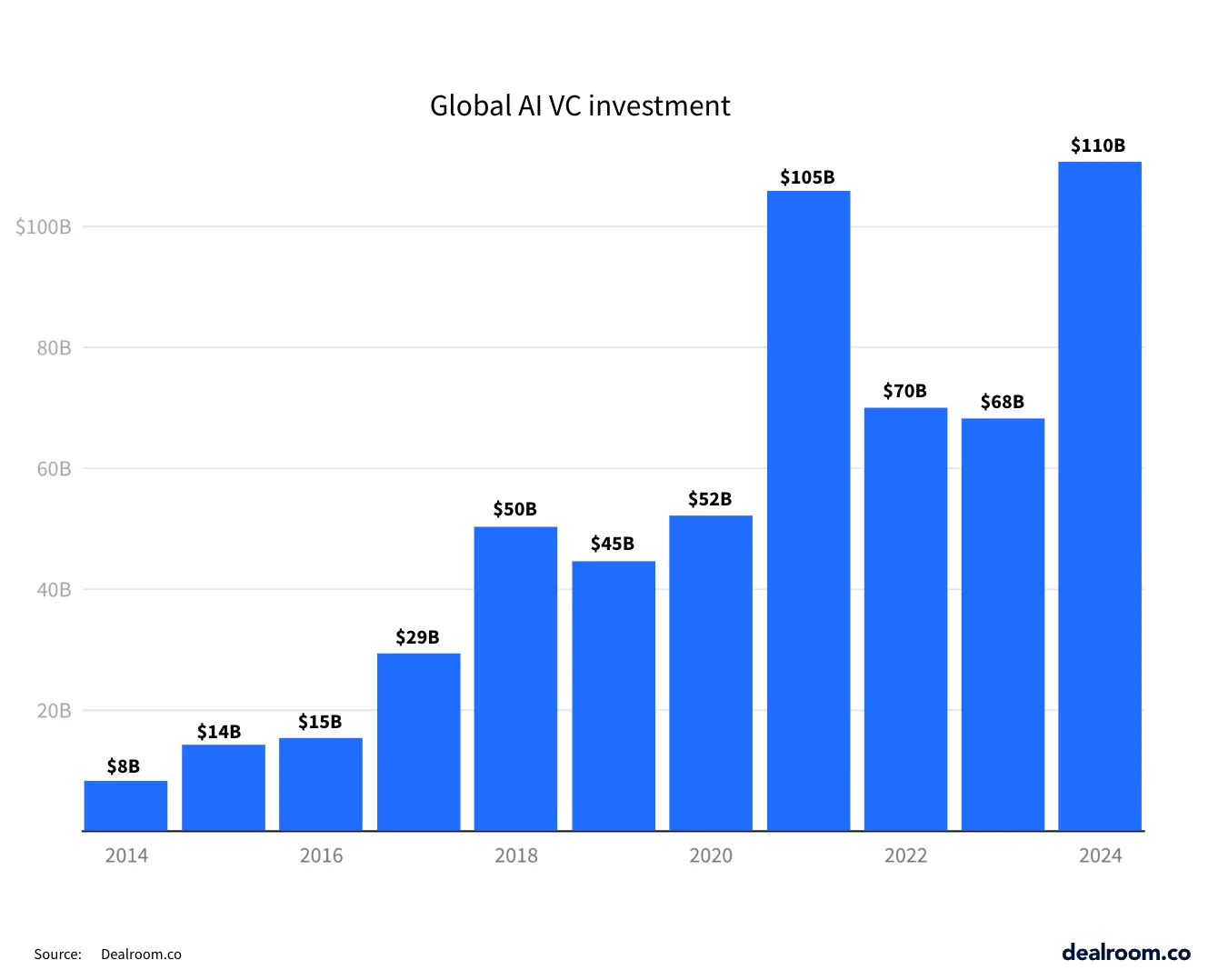

- AI startups raised an astonishing $110 billion in 2024, marking a 62% surge compared to the previous year, according to new data from Dealroom.

- Across all technology sectors, privately-backed companies—including startups and scale-ups—secured $227 billion in 2024. This figure represents a 12% drop from 2023, signaling a shift in investor focus.

- Yoram Wijngaarde, Dealroom’s founder, highlighted that the current AI investment boom surpasses even the marketplace frenzy of the late 1990s and early 2000s in terms of scale and impact. “This is the biggest wave ever by absolute amounts invested,” he said. “There’s never been anything like it.”

Why AI Is Leading The Charge

The explosive growth in AI funding can be attributed to its vast, expanding ecosystem. From hardware and infrastructure to applications and foundational models, AI’s reach is broadening, attracting diverse areas of investment.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

Notable AI funding rounds in 2024 reflect this diversity. Companies like Anthropic (large language models, generative AI), Waymo (self-driving tech), Anduril (defense), xAI (applications), Databricks (AI data management), and Vantage (data centers and infrastructure) dominated the top fundraising spots.

Despite its high profile, OpenAI did not lead in terms of funding raised last year. That honor went to Databricks, which secured $10 billion, surpassing OpenAI’s $6.6 billion. However, with over $20 billion in total funding to date, and another $40 billion reportedly in the pipeline, OpenAI remains a key industry player, notably due to its viral app, ChatGPT.

Generative AI And Foundational Models: The Key Drivers

The surge in investment can largely be attributed to generative AI and foundational models—two of OpenAI’s core business areas. In 2024 alone, generative AI companies raised a remarkable $47.4 billion, and foundational AI technology continued to gain ground, overtaking AI applications in both growth and funding over the past two years.

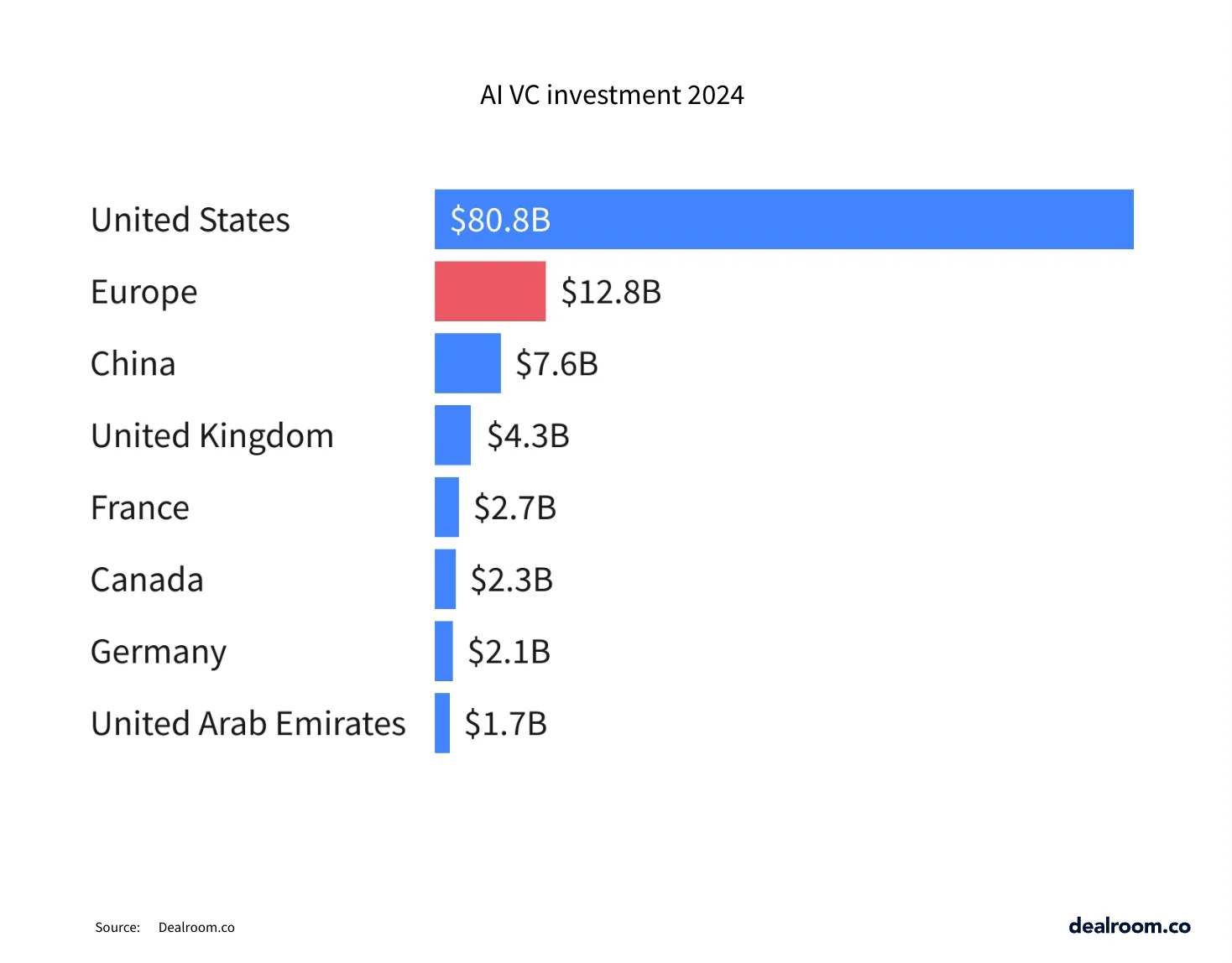

Regional Disparities: The US Leads, Europe Lags

The Dealroom report also sheds light on a regional imbalance in AI funding. In 2024, a staggering 42% of all U.S. venture capital ($80.7 billion) went to AI startups, while Europe received only 25% ($12.8 billion) and the rest of the world secured 18%. China emerged as a key player, investing $7.6 billion in AI startups.

“In Europe, we have a bit of an innovators’ dilemma,” Wijngaarde explained. “We don’t want to replace what we have, which can lead to a less aggressive stance.”

Open Source AI: A Modest Growth Story

Another emerging trend in AI investment is the rise of open-source AI projects. While startups building open-source AI raised 12% of total AI venture capital last year, the potential for this sector to expand remains significant, according to Dealroom. However, defining what qualifies as “open-source” is still a gray area. For instance, xAI’s Grok-2, though not open-source, would push the open-source percentage to 22% if included.

The emergence of alternatives like DeepSeek, which built an OpenAI rival for just $50, hints at a potential shift toward more cost-effective, open-source solutions.

Top VC Firms: Leading The Charge

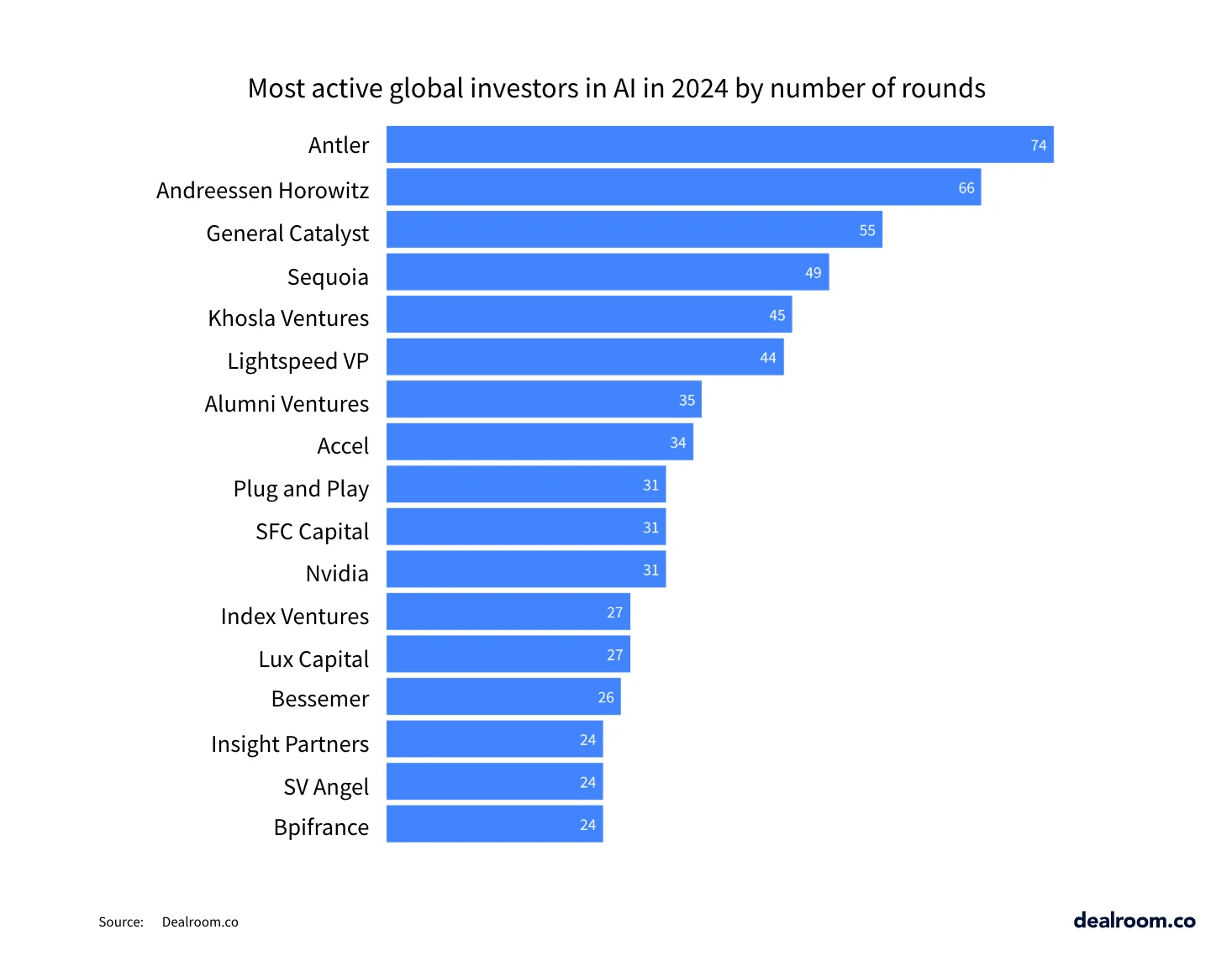

The most active venture capital firm in AI investment last year was Antler, followed by heavyweights like a16z, General Catalyst, Sequoia, and Khosla Ventures.

Looking Ahead: What’s Next For AI In 2025?

As we move into 2025, the question remains: How will this AI funding boom evolve? Will the open-source movement gain more traction, or will the dominance of large language models and foundational models continue to attract the bulk of investment? With AI infrastructure still costly to build and operate, it’s clear that the landscape will keep evolving in exciting ways.

What’s certain is that AI remains a central pillar of innovation and investment, shaping the future of technology and business across the globe.