The answer depends largely on where you live. A recent report by BestBrokers compares property prices across Europe to average salaries, offering insights into how many months of income it would take to afford a home.

Where in Europe is Buying a Home Most Affordable?

Denmark leads the pack as the most affordable country in Europe for homebuyers. According to the report, purchasing a 100-square-metre property in Denmark costs the equivalent of 114 net monthly salaries, making it the shortest saving time in Europe.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

The report considered factors such as average net income, inflation, and “real” mortgage interest rates—mortgage rates adjusted for inflation. It’s important to note that the calculation assumes no spending on food, housing, childcare, or other expenses, offering a purely theoretical outlook.

Interestingly, despite ranking as Europe’s most affordable housing market, Denmark also holds the title of the most expensive EU country for goods and services, with prices 43% above the EU average in 2023, according to Eurostat. Still, Denmark’s relatively high average earnings—seventh in Europe—offset these costs.

Following Denmark, Ireland, and Sweden rank as the second and third most affordable European countries to buy a home. A 100-square-metre property costs the equivalent of 123 and 129 net monthly salaries in these nations, respectively—roughly 10 years of annual earnings.

Which European Countries Make Saving for a Home the Hardest?

At the opposite end of the spectrum are the Czech Republic and Slovakia, where saving for a home takes considerably longer. In Slovakia, for example, buying a 100-square-metre property costs 297 net monthly salaries—nearly 25 years of earnings. Even if someone managed to save half their income every month, it would take 50 years of disciplined saving to afford a home.

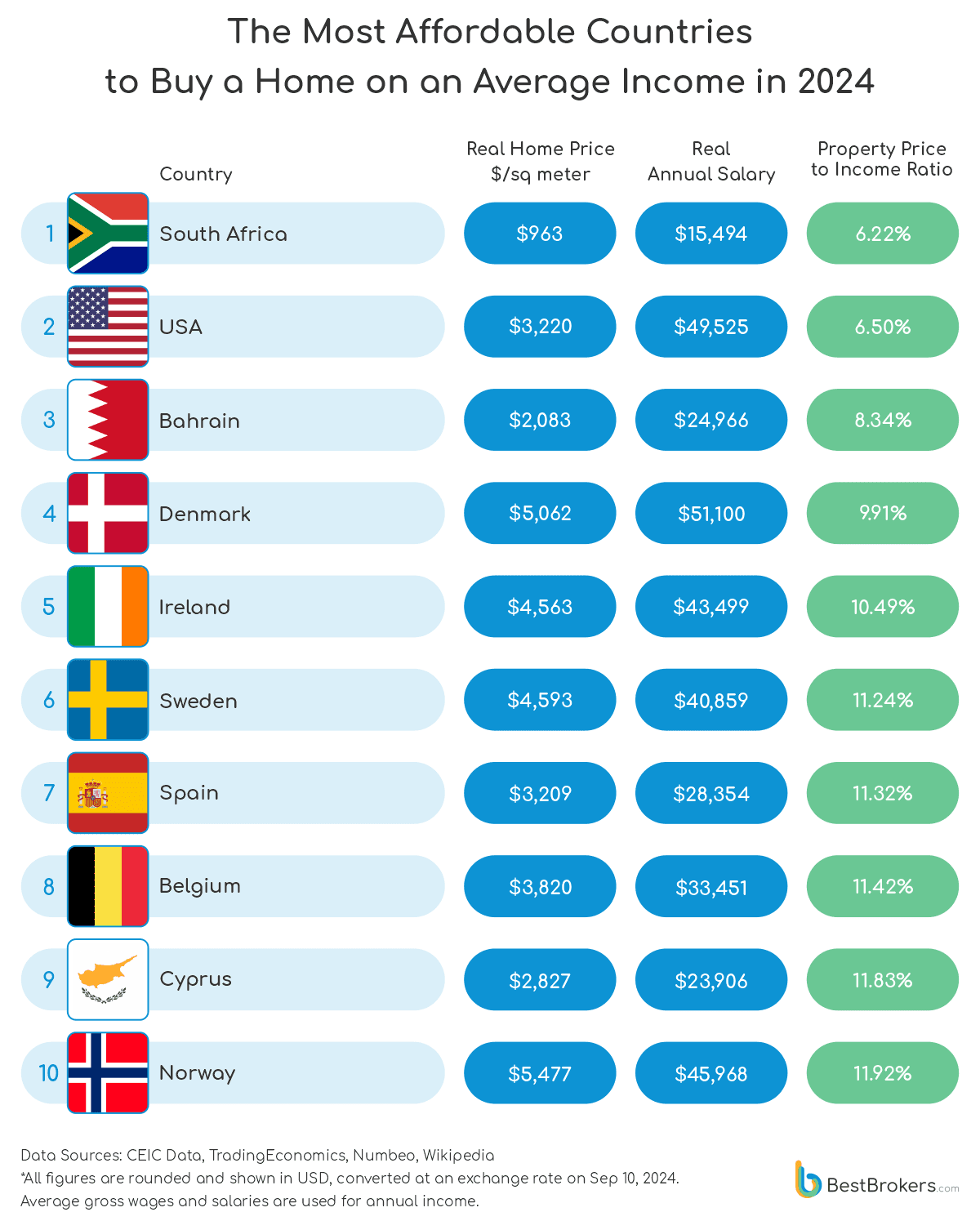

Where Are Homes the Most Affordable Globally?

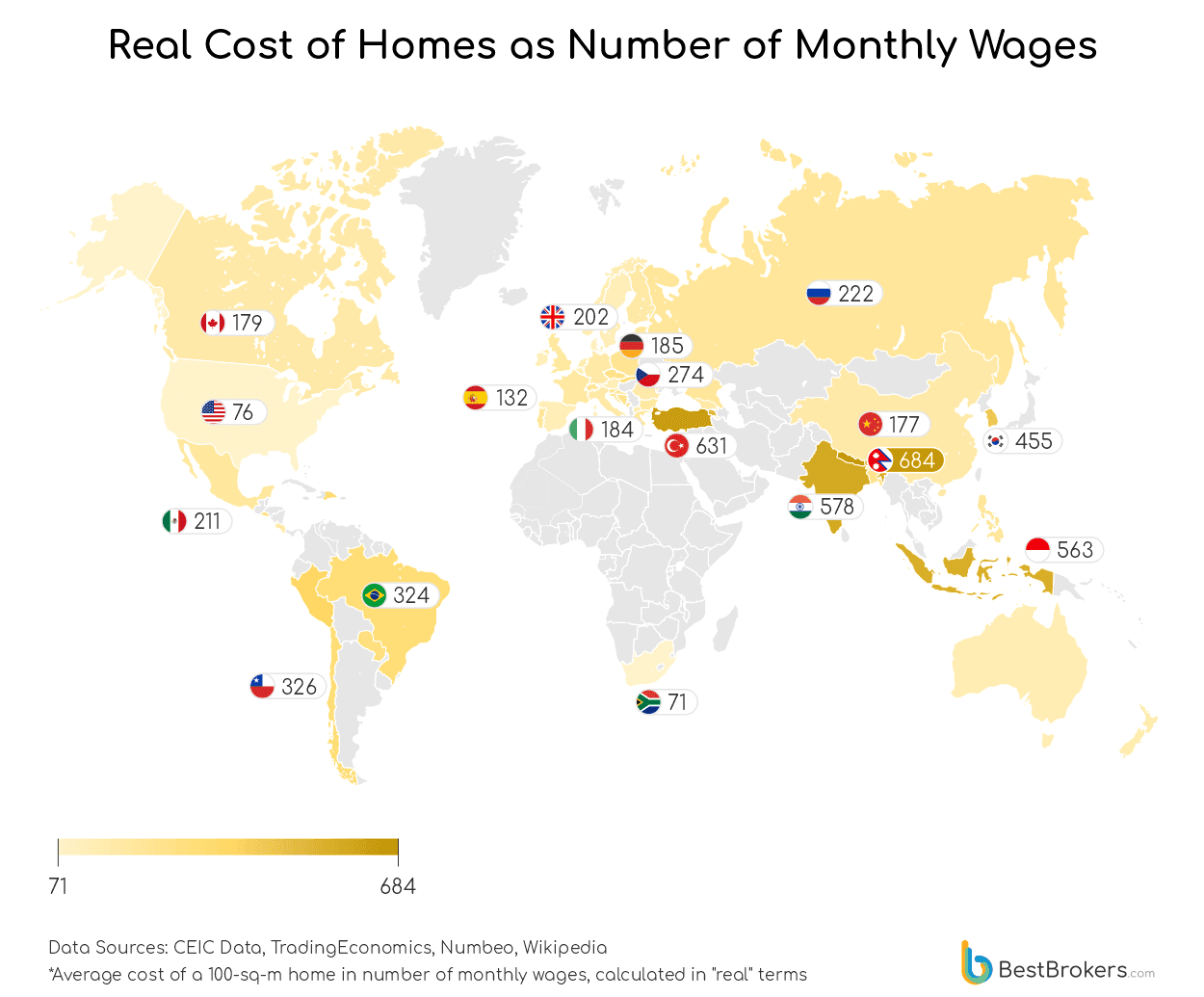

Globally, South Africa emerges as the most affordable country to buy a home. A 100-square-metre property costs 71 times the average monthly salary, making it the fastest place in the world to save for a house. The United States comes second, requiring 76 monthly wages—equivalent to approximately six years of annual income. However, property affordability varies greatly between states in the U.S., with some regions significantly more expensive than others.

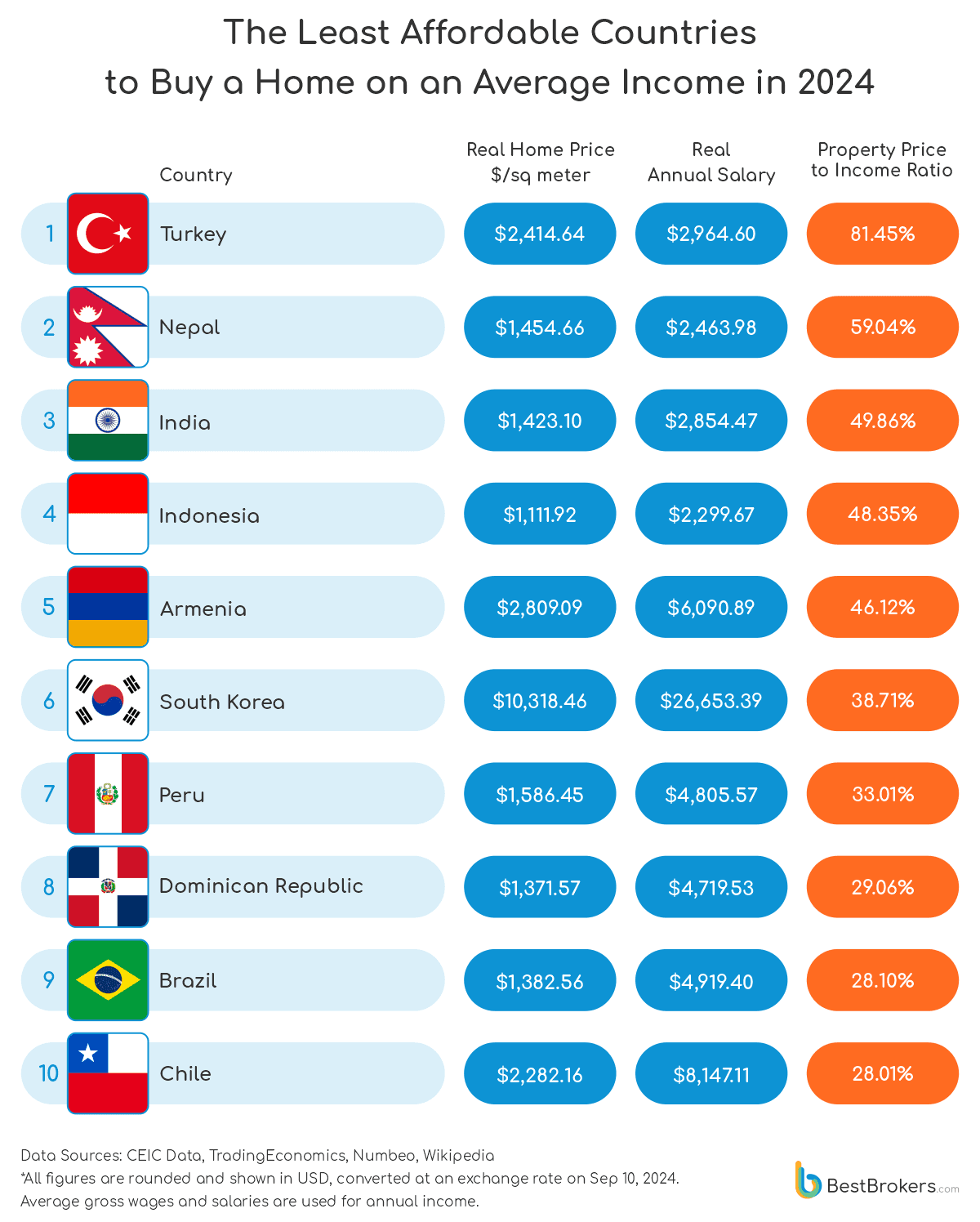

The World’s Least Affordable Housing Markets

On the flip side, Nepal holds the title for the least affordable housing market, where a 100-square-metre home costs a staggering 684 monthly salaries. Turkey follows closely behind, with homes priced at 631 net wages, or over 52 years of income.

How Many Monthly Salaries Does a 100-sq-metre Home Cost Around the World?

Final Thoughts

This report sheds light on the stark disparities in housing affordability across Europe and the world. Whether you’re planning to buy a home in Denmark or dreaming of saving in Slovakia, understanding the cost-to-salary ratio is crucial for making informed financial decisions.

Disclaimer: The information provided does not constitute financial advice. Always conduct your own research to ensure it aligns with your personal circumstances. While we strive to deliver expert-backed guidance, reliance on this content is at your own risk.