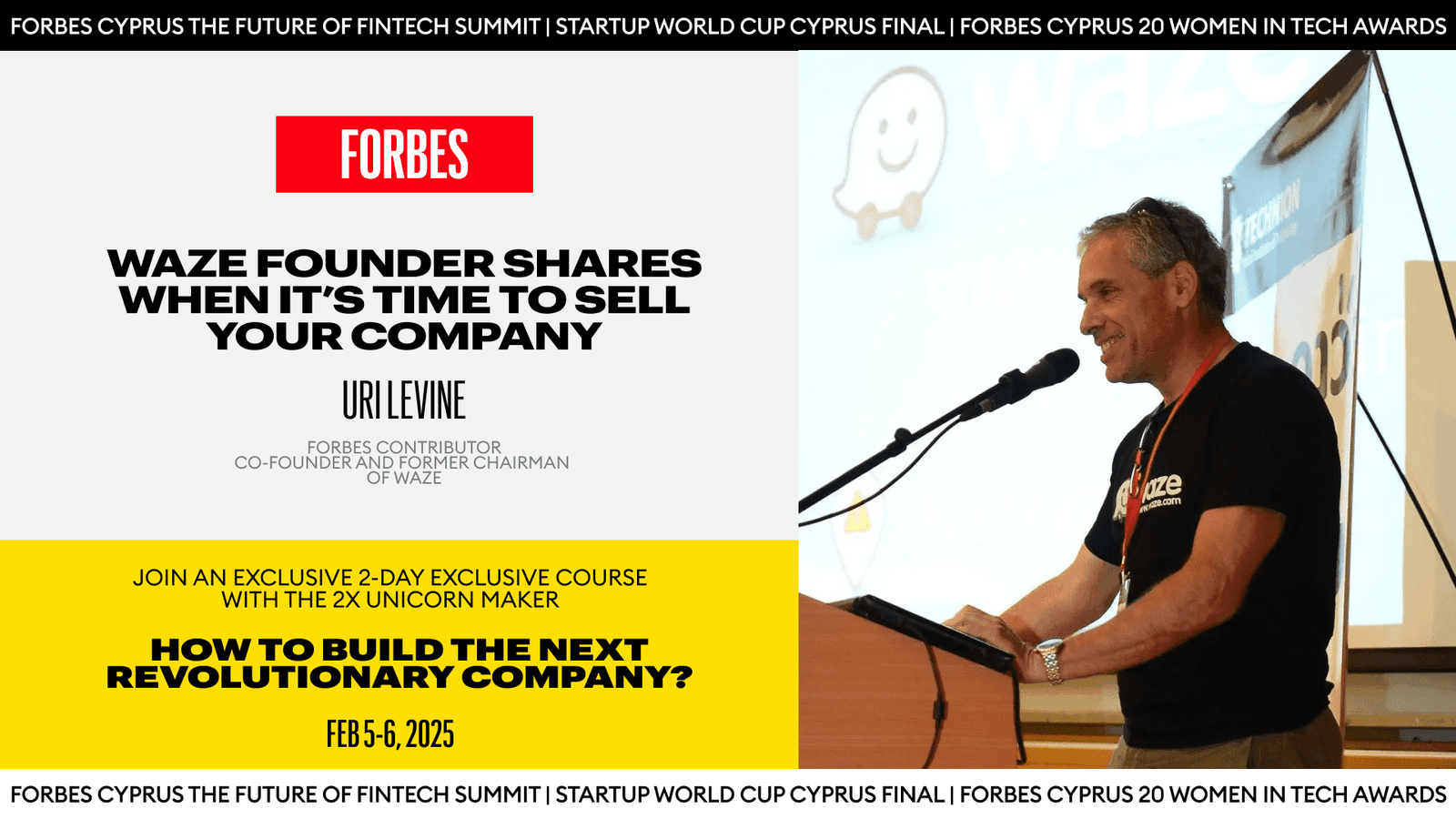

I am frequently asked whether selling Waze to Google was the right decision. My answer remains the same: there are only right decisions or no decisions at all.

When you make a decision, you don’t know what it would be like if you had chosen a different path.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

If you were to ask me if Waze is worth more today than it was 11 years ago, then of course it is. Back then, Waze was a unicorn that sold for $1.15 billion, however, what we don’t know is whether Waze would have become what it is today without the decision back in 2013.

Build Your Company to Greatness

Viewing it as “selling your company” is the wrong approach. You don’t “sell your company”; rather, someone makes you an offer. If the offer is too good to refuse, then you don’t refuse it.

For someone to make you an offer, you must build a great company first. One that someone would be interested in. You will get a good offer – and hopefully more than one – if you have multiple options like keep running the company, raise capital, become profitable, etc. Therefore, the main focus should be on striving for greatness.

Evaluate Offers

When an offer arrives, how do you decide?

I would say there are two concurrent paths that you should think of:

- Is this an offer I would like to consider?

- How do I make the most out of this offer?

Here is my general rule for considering an offer: thoroughly evaluate all four aspects before making a decision.

1. Is this a life-changing event for you?

If it is, start thinking about this favorably.

2. Is this going to be a life-changing event for your team?

If yes, start to think about it even more favorably. If not – can you negotiate the deal to be such? Your team comes first, even before you, and definitely before other stakeholders.

3. Is this company once in a lifetime for you, or do you believe you will have more journeys?

When Waze was acquired, I had already started Pontera and was part of Moovit.

4. Do you like the day after?

For your investors – they simply take the money and run – there is no day after. For the rest of the team, there are no major differences the day after since the organization remains pretty much the same, but for you, it’s a new ball game. All of a sudden, you become part of a larger organization that may have a different agenda and you need to report to someone else – make sure you like the day after, or at least it is worth it.

The second path is about negotiation. The most important rule is simple, if you want the deal that you like, you have to say no to the deal that you don’t like!

The easiest way to say no is to have a better alternative, so once you think offers might come, start creating alternatives, and start dialogues with other potential acquirers, private equity firms, and bankers to create other options.

One critical thing to note is that getting the first offer is amazing, but it is just the first one. If you keep creating value, more offers will come, even from the same acquirer.

The Emotional Roller Coaster

On a personal note, while I’m trying to remain as rational as possible, and set up the criteria for making the decision, when there is an offer, it is an emotional roller coaster. The journey, the success, the life-changing event, the future, your friends, your team, your family – everything is intermixed together.

To an extent, it is even more dramatic than the beginning. The number of different thoughts crossing your mind is nearly overwhelming and the realization that your decision will need to be quick creates an even bigger pressure.

In my book, Fall in Love with the Problem, Not the Solution – A Handbook for Entrepreneurs, I describe building a startup as a roller coaster journey, fundraising as a roller coaster in the dark in which you don’t even know what’s coming, and closing a funding round is in the dark and upside down.

Entering into an M&A transaction deal can feel disorienting and unpredictable, making the closing of such a deal seem almost unimaginable due to the intense emotions involved. This is how emotional it gets.

The Day After Selling Your Company

The day after – for me, it marked the beginning of a new journey, or perhaps I should say multiple journeys, as I continued to build additional startups as part of my entrepreneurship journey.

The course

The course will be organized around the key components of building a successful start-up, all with compelling real-world stories of the companies Uri founded.

More information here.