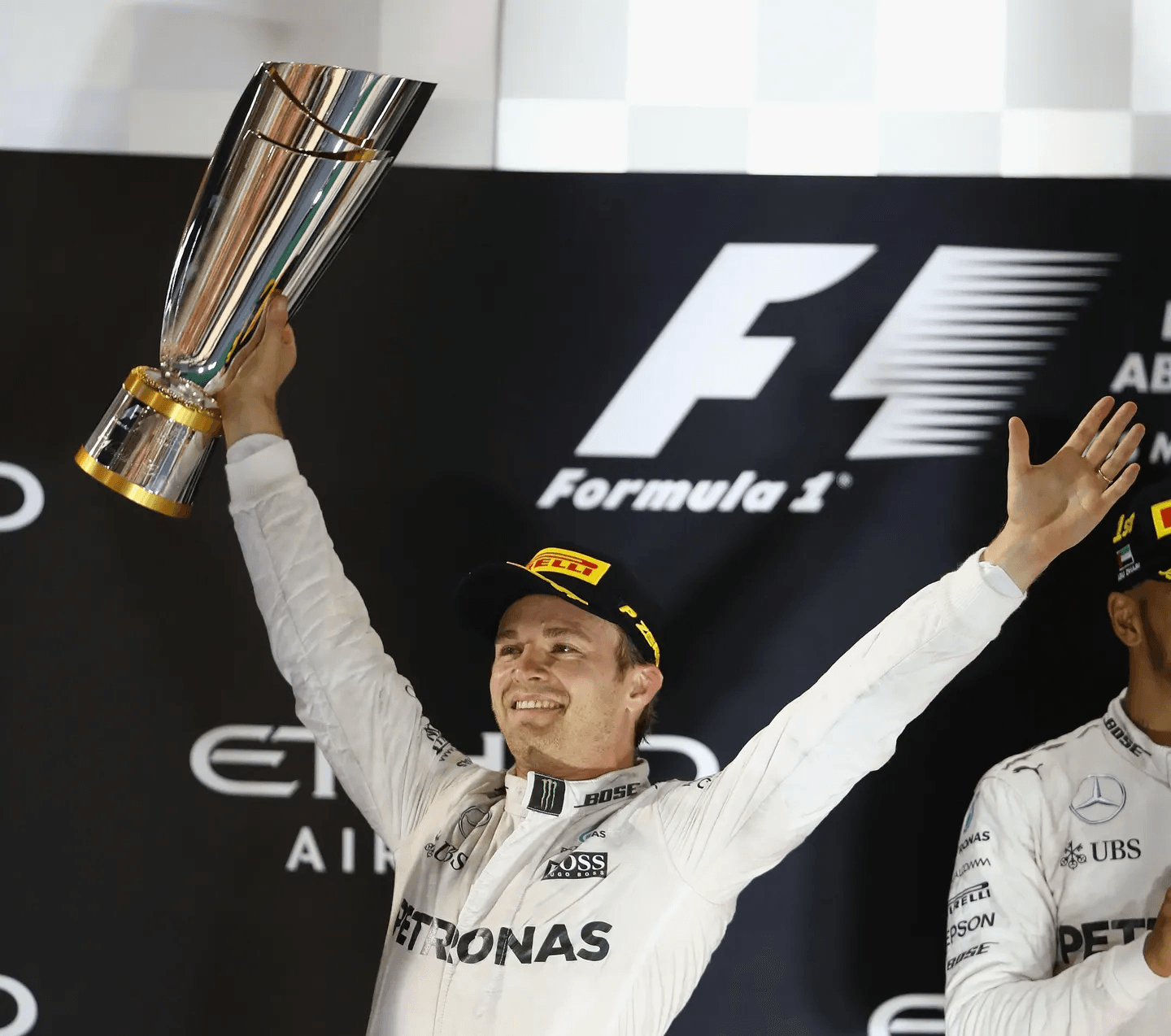

Nico Rosberg used to careen around the narrow streets of Monte Carlo at 200 miles an hour, but anyone with a pulse might feel their heart skip a beat trying to approach a venture capital legend like Floodgate cofounding partner Mike Maples Jr. at a business conference. And with hundreds of admirers circling Maples at this summit in New York last month, even a passing word might have seemed impossible.

The 39-year-old Rosberg has a pretty effective icebreaker in just this sort of situation, however.

Follow THE FUTURE on LinkedIn, Facebook, Instagram, X and Telegram

“I’m very humble usually, but I have to use the two-second intro to set myself apart,” he says. “So I just went straight [up to him], and I was like, ‘Hey, I’m Formula 1 world champion Nico.’”

Clive Mason/Getty Images

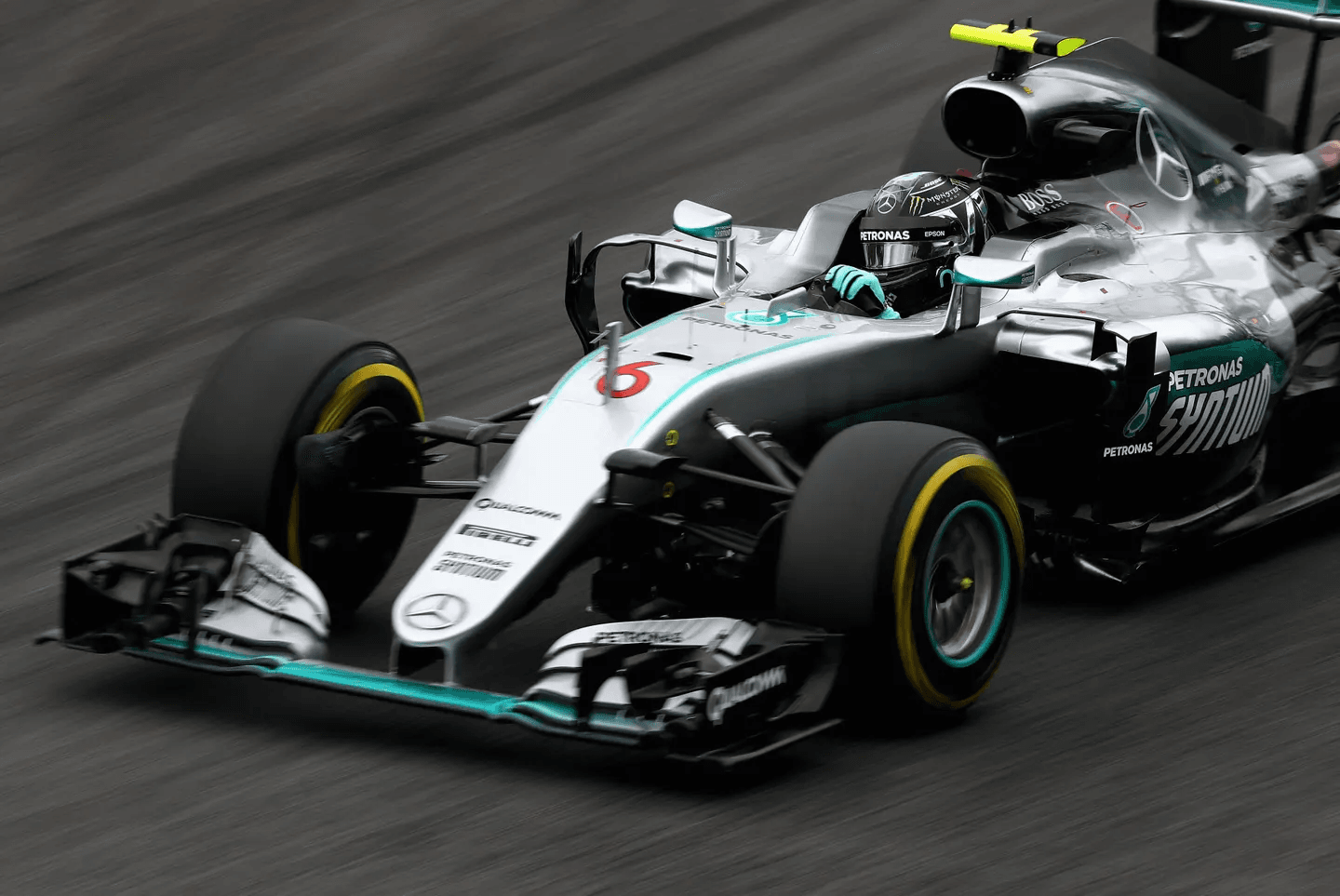

He indeed scored a few minutes with Maples that day—hardly the first time that Rosberg, who spent 11 seasons racing for the Williams and Mercedes teams, has leaned into his success on the F1 grid to endear himself to a whole new audience of founders and investors. Since claiming his final checkered flag in 2016, the German-born Rosberg has been busy rebranding himself as an entrepreneur, seeding more than 30 companies and founding a few of his own. Now, with a network spanning from Silicon Valley to Western Europe, the former racecar driver is getting behind the wheel of his most ambitious endeavor yet: managing a fund.

In April, his Monaco-based firm Rosberg Ventures announced the creation of a “fund of funds,” which pools capital and deploys it primarily through other VC firms, rather than investing directly in startups. Rosberg now tells Forbes exclusively that he has secured $100 million in assets under management, which includes at least $5 million of his own money. The goal, he says, is to index the top U.S. venture capital firms because “it makes a lot of sense to give your money to the best in the world.”

It’s a smart strategy. A 2014 study from financial services company Wealthfront found that 95% of the American venture capital industry’s realized returns were generated by the top 20 firms, a figure that the report’s author, Andy Rachleff, says still holds true.

But those results have also made leading firms like Andreessen Horowitz, Kleiner Perkins and Thrive Capital so desirable that they have to turn away eager investors. And that competitive ecosystem is part of Rosberg’s pitch: For his customers—mostly ultra-high-net-worth families from Germany and Italy that aren’t wired into Silicon Valley—he can leverage his connections to provide something they can’t quite find back home.

“It very much becomes an access class rather than an asset class because all the returns are captured by these very few top firms,” Rosberg says. “The winners keep winning.”

That kind of dynastic dominance is a familiar concept to Rosberg, albeit in a much different arena. As a member of the Mercedes-AMG Petronas Formula 1 team, he helped deliver three consecutive constructors’ championships, the start of an unprecedented eight-title run under billionaire owner and team principal Toto Wolff. But in 2016, after edging his teammate Lewis Hamilton for the drivers’ title, Rosberg shocked the racing world and abruptly called it quits at age 31.

He quickly shifted his focus to angel investing and joined a trend of star athletes becoming true entrepreneurs, not just endorsers. For instance, Los Angeles Lakers forward LeBron James, who cofounded entertainment development and production company SpringHill, became the first active athlete with a $1 billion net worth in 2022, and Pro Football Hall of Famer Joe Montana and tennis legend Serena Williams have found success in venture capital. And Rosberg had money to put to work after racking up nearly $80 million in career pretax earnings from his F1 salary and performance bonuses, according to Forbes estimates.

“As an athlete or a celebrity, generally speaking, you do get access,” says a partner at a leading Silicon Valley venture firm where Rosberg is an investor. “You do get that sort of foot in the door because people want to get to know you; they want to connect with you. … If you’re able to get in front of the best companies and you’re able to deliver value and have an allocation to invest, it’s kind of a no-brainer.”

Rosberg’s Formula 1 ties spurred his first opportunity shortly after he left the sport. Mercedes-Benz—the carmaker, which owns a third of the racing team—was investing in electric vehicle infrastructure startup ChargePoint and invited him to participate. He wrote a five-figure check and exited after the company went public in 2021. Rosberg declines to share exactly how much he made on the deal but says it was “many multiples of what I had invested.”

His portfolio only grew from there, casting a wide net across industries including car sharing (Vay) and artificial intelligence (Codeium), at an average of $50,000 a pop. He picked up one stake, in digital payments startup Ivy, after penning a series of cold emails. “I thought, ‘OK, I respect the hustle; let’s meet,’” says Ivy cofounder Ferdinand Dabitz.

And while balance sheets aren’t necessarily his area of expertise, Rosberg has found other ways to add value, like introducing Dabitz to a European transportation CEO, a prospective Ivy customer.

Through co-investing opportunities, cold outreach and introductions by founders, Rosberg started to cement his reputation in the venture capital space. Netflix’s Drive To Survive reality series, which helped Formula 1 reach a new level of popularity in the U.S., didn’t hurt, either. Still, Rosberg faced a series of rejections as he tried to invest his cash with top funds. On his fifth unsuccessful attempt, Andreessen Horowitz offered him some advice, suggesting he approach firms with bigger checks and a clear way of standing out.

Clive Mason/Getty Images

So Rosberg, who was born in Germany and raised in Monaco, decided to string together capital and turned his sights back across the Atlantic. The European venture market is far less mature and has raised only about a third of its American counterpart’s $140 billion so far in 2024, according to Crunchbase. “You really don’t have the equivalent of Silicon Valley or even New York,” says Nigel Morris, managing partner of fintech venture firm QED Investors and a prominent English businessman who has not yet worked with Rosberg. Morris adds that the region lags in market vibrancy or the quality and rate of deals and that investors must contend with regulatory and cultural differences from country to country.

Rosberg—who had a leg up making a name for himself as the son of former Formula 1 champion Keke Rosberg and boosted his celebrity in a multi-season stint on Germany’s Shark Tank sister show, Die Höhle der Löwen (The Lion’s Den)—found his way in the door with the families behind German mid- and large-cap companies. He also connected with investors in Italy, where he has a large fan base. And he had a unique proposition to sell them: access.

“If you are not getting into the very best funds in venture, your average portfolio will show unsatisfying returns,” says a member of a leading German industrial family that has invested with Rosberg. “There are a lot of people in the industry who walk around and are giving promises of what they can achieve, but Nico is delivering.”

With a network of European investors at his disposal, Rosberg had a largely untapped pool of capital to get the big funds’ attention. He quietly raised $22 million near the end of 2022 and, as the calendar turned over, committed the entirety of it to a single Tier 1 firm. (He declines to say which.) That directly led to the fund of funds, which set out in April to raise $75 million and finished with an oversubscribed $78 million, from about 25 investors. It will be fully deployed within two years, although Rosberg again declines to share exactly which firms will be through.

Judging the fund’s performance will take far longer. It’s running on a 10-year cycle, with the potential to add three-year extensions, mimicking how the underlying funds operate. The industry’s best have historically averaged a 25% annual return, but going forward, Rosberg says, there’s a consensus that that mark may be a bit worse across the board—or “slightly more compressed,” in his words. He plans to raise a new fund of funds every two years to stay active as the top firms offer new opportunities.

While that money is being managed elsewhere, Rosberg will hardly be sitting still. He is regularly hosting events at Formula 1 races and fostering new relationships across his network. In fact, he helped broker a revenue-sharing partnership between German tech firm SAP and compliance automation startup SecJur.

“We connect,” Rosberg says. “This is what we do.”